Nike 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NIKE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

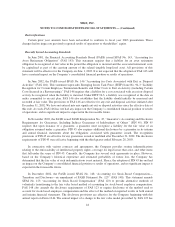

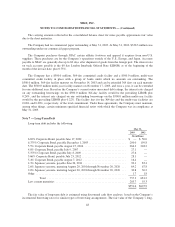

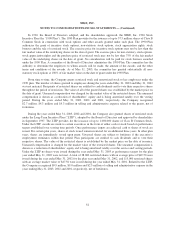

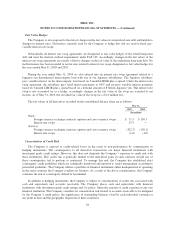

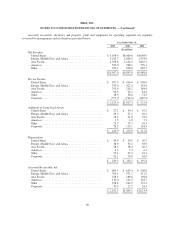

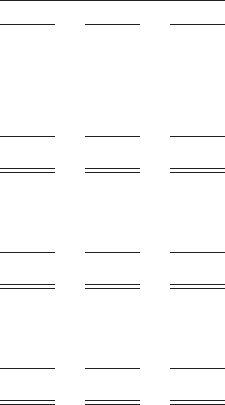

Note 11 — Earnings Per Share

The following represents a reconciliation from basic earnings per share to diluted earnings per share.

Options to purchase 11.7 million, 4.2 million, and 8.3 million shares of common stock were outstanding at

May 31, 2003, 2002, and 2001, respectively, but were not included in the computation of diluted earnings per

share because the options’ exercise prices were greater than the average market price of the common shares and,

therefore, the effect would be antidilutive.

Year Ended May 31,

2003 2002 2001

(In millions,

except per share data)

Determination of shares:

Average common shares outstanding .......................... 264.5 267.7 270.0

Assumed conversion of dilutive stock options and awards ......... 3.1 4.5 3.3

Diluted average common shares outstanding ...................... 267.6 272.2 273.3

Basic earnings per common share — before cumulative effect of

accountingchange ........................................ $ 2.80 $ 2.50 $ 2.18

Cumulative effect of accounting change ......................... 1.01 0.02 —

$ 1.79 $ 2.48 $ 2.18

Diluted earnings per common share — before cumulative effect of

accountingchange ........................................ $ 2.77 $ 2.46 $ 2.16

Cumulative effect of accounting change ......................... 1.00 0.02 —

$ 1.77 $ 2.44 $ 2.16

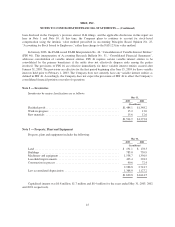

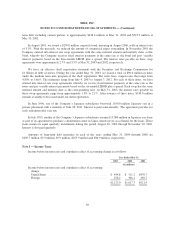

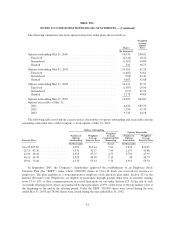

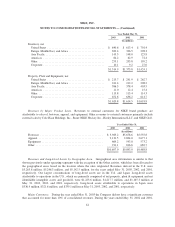

Note 12 — Benefit Plans

The Company has a profit sharing plan available to substantially all U.S.-based employees. The terms of the

plan call for annual contributions by the Company as determined by the Board of Directors. Contributions of

$16.0 million, $14.4 million, and $13.1 million to the plan are included in other income/expense in the

consolidated financial statements for the years ended May 31, 2003, 2002 and 2001, respectively. The Company

has a voluntary 401(k) employee savings plan. The Company matches a portion of employee contributions with

common stock. Plan changes during the year ended May 31, 2001 included a larger Company match percentage

and a change to immediate vesting of the Company match, compared to a previous vesting schedule over 5 years.

Company contributions to the savings plan were $15.0 million, $13.7 million, and $12.7 million for the years

ended May 31, 2003, 2002 and 2001, respectively, and are included in selling and administrative expenses.

Note 13 — Interest Income

Included in other income/expense for the years ended May 31, 2003, 2002, and 2001, was interest income of

$14.1 million, $13.6 million and $13.9 million, respectively.

54