Nike 2003 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NIKE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Note 4 — Identifiable Intangible Assets and Goodwill:

Adoption of FAS 142

The Company adopted Statement of Financial Accounting Standards No. 142, “Goodwill and Other

Intangible Assets,” (FAS 142) effective June 1, 2002. In accordance with FAS 142, goodwill and intangible

assets with indefinite lives will no longer be amortized but instead will be measured for impairment at least

annually, or when events indicate that an impairment exists. Intangible assets that are determined to have definite

lives will continue to be amortized over their useful lives.

As required by FAS 142, the Company performed impairment tests on goodwill and other intangible assets

with indefinite lives, which consisted only of certain trademarks, as of June 1, 2002. As a result of the

impairment tests, the Company recorded a $266.1 million cumulative effect of accounting change. Under

FAS 142, goodwill impairment exists if the net book value of a reporting unit exceeds its estimated fair value.

The Company estimated the fair value of its reporting units by using a combination of discounted cash flow

analyses and comparisons with the market values of similar publicly-traded companies.

Included in the Company’s $266.1 million impairment charge was a $178.5 million charge related to the

impairment of the goodwill associated with the Bauer NIKE Hockey (“Bauer”) and Cole Haan reporting units.

These reporting units are reflected in the Company’s “Other” operating segment. Since the Company’s purchase

of Bauer in 1995, the hockey equipment and apparel markets have not grown as fast as expected and the in-line

skate market has contracted significantly. As a result, we determined that the goodwill acquired at Bauer had

been impaired. The goodwill impairment at Cole Haan reflected the significantly lower fair value calculated on

the basis of reduced operating income in the year following the September 11, 2001 terrorist attacks.

The remaining $87.6 million of the impairment charge relates to trademarks associated with Bauer. Under

FAS 142, impairment of an indefinite-lived asset exists if the net book value of the asset exceeds its fair value.

The Company estimated the fair value of trademarks using the relief-from-royalty approach, which is a standard

form of discounted cash flow analysis typically used for the valuation of trademarks. The impairment of the

Bauer trademarks reflects the same circumstances as described above related to the Bauer goodwill impairment.

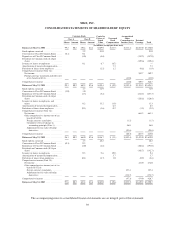

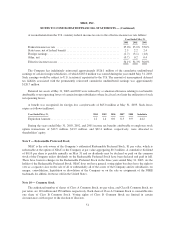

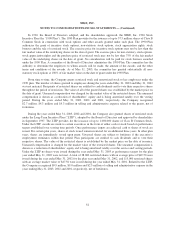

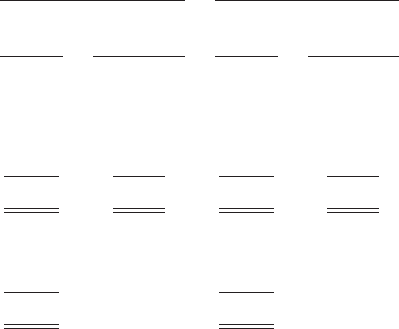

The following table summarizes the Company’s identifiable intangible assets and goodwill balances as of

May 31, 2003 and May 31, 2002:

May 31, 2003 May 31, 2002

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

(In millions)

Amortized intangible assets:

Patents ................................ $ 24.9 $(10.4) $ 23.1 $ (8.8)

Trademarks ............................ 12.9 (10.6) 12.0 (9.8)

Other ................................. 7.5 (1.1) 7.5 (0.2)

Total................................ $ 45.3 $(22.1) $ 42.6 $(18.8)

Unamortized intangible assets:

Goodwill .............................. $ 65.6 $232.7

Trademarks ............................ 95.0 182.2

Total................................ $160.6 $414.9

46