Nike 2003 Annual Report Download - page 25

Download and view the complete annual report

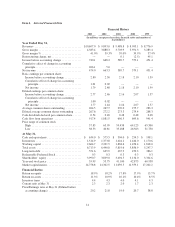

Please find page 25 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other income/expense was net expense of $79.9 million compared to net expense of $3.0 million in fiscal

2002. Significant amounts included in other income/expense were interest income, profit sharing expense,

goodwill amortization (fiscal 2002 only), and certain foreign currency gains and losses.

An increase in net foreign currency losses was the largest contributor to the increase in other expense versus

last year. These foreign currency losses were primarily due to hedge losses on intercompany charges to a

European subsidiary, whose functional currency is the euro. These losses are reflected in the Corporate line in

our segment presentation of pre-tax income in Note 17 — Operating Segments and Related Information. The

hedge losses reflected that the euro has strengthened considerably since we entered into these hedge contracts. In

fiscal 2003, net foreign currency losses in other income/expense were more than offset by favorable translation

of foreign currency denominated profits. Our estimate of the net impact of these losses and the favorable

translation is a $13 million addition to consolidated income before income taxes. Consistent with our existing

policies, we have continued to hedge anticipated intercompany charges for fiscal 2004. Since the euro has

continued to strengthen since these hedge contracts were executed, we expect to continue to incur some hedge

losses in fiscal 2004. However, we expect the net impact of the hedge losses and the offsetting positive

translation impact will result in a net benefit to fiscal 2004 consolidated net income versus the prior year.

Our fiscal 2003 effective tax rate was 34.1%, relatively consistent with the fiscal 2002 effective rate of

34.3%.

Included in fiscal 2003 net income was a $266.1 million charge for the cumulative effect of implementing

FAS 142. This charge related to the impairment of goodwill and trademarks associated with Bauer NIKE Hockey

and the goodwill of Cole Haan, reflecting that the fair values we estimated for these assets were less than the

carrying values. In addition, the adoption of this accounting standard resulted in a reduction to goodwill and

intangible asset amortization of $13.1 million as compared to fiscal 2002. See the accompanying Notes to

Consolidated Financial Statements (Note 4 — Identifiable Intangible Assets and Goodwill) for further

information.

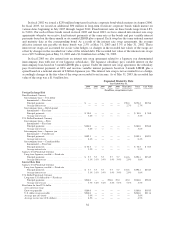

Fiscal 2002 Compared to Fiscal 2001

• Revenues increased 4% to $9.9 billion, compared to $9.5 billion in fiscal 2001.

• Income before the cumulative effect of an accounting change increased to $668.3 million from

$589.7 million in the prior year, an increase of 13%. After the effect of the accounting change, net income

rose 12%.

• Diluted earnings per share before the effect of the accounting change increased by 14%, from $2.16 to

$2.46. After the effect of the accounting change, diluted earnings per share rose 13%.

• Gross margins increased as a percentage of revenues to 39.3% from 39.0% in fiscal 2001.

• Selling and administrative expense increased as a percentage of revenues to 28.5% from 28.3% in fiscal

2001.

• Included in fiscal 2002 net income was a $5.0 million after-tax loss related to the cumulative effect of the

adoption of SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities.”

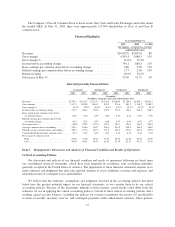

As discussed above, our fiscal 2002 and fiscal 2001 Nike Golf information has been reclassified to conform

to the fiscal 2003 presentation. This presentation reflects significant NIKE Golf operations as a separate business

in the Other category rather than within each of our geographical regions. The following discussion of fiscal

2002 results versus fiscal 2001 by region reflects this reclassification of NIKE Golf operations. This

reclassification did not result in any change to our previously reported consolidated results, nor did it result in a

significant change to the previously reported revenue and profitability trends in each of our regional businesses in

fiscal 2002. This reclassification did result in significantly higher revenues and profits reported in the Other

category.

24