Nike 2003 Annual Report Download - page 12

Download and view the complete annual report

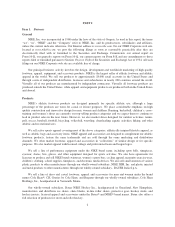

Please find page 12 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.April 4, 2001. On July 23, 2001, the cases were consolidated as In re NIKE, Inc. Securities Litigation,

CV-01-332-K. The consolidated amended complaint sought unspecified damages on behalf of a purported class

consisting of purchasers of the Company’s stock during the period December 20, 2000 through February 26,

2001. Plaintiffs allege that the defendants made false and misleading statements about the Company’s actual and

expected business and financial performance in violation of federal securities laws. Plaintiffs further allege that

certain individual defendants sold Company stock while in possession of material non-public information. In

January 2002, the Court dismissed this action with leave to amend. On February 25, 2002, plaintiffs filed an

amended complaint extending the purported class period to June 29, 2000 through February 26, 2001 and

containing the essential allegations. On or about October 18, 2002, the Company and the individual defendants

reached an agreement with the plaintiffs to resolve and release all claims asserted in the litigation in exchange for

the payment of $8.9 million, which was funded by the Company’s directors and officers liability insurers. The

stipulation of settlement dated as of October 18, 2002 provided that the Company and the individual defendants

denied any liability or wrongdoing, and the claims were being settled to avoid the uncertainties, burdens and

expense of further litigation. On February 24, 2003, the U.S. District Court for the District of Oregon issued an

order granting final approval of the settlement and entered judgment dismissing the case with prejudice.

Another related shareholder derivative lawsuit, Metivier v. Denunzio, et al., 0104-04339, was filed in the

Multnomah County Circuit Court of the State of Oregon on April 26, 2001. The state derivative suit was brought

by a Company shareholder, allegedly on behalf of the Company, against certain directors and officers of the

Company. The derivative plaintiff alleges that these officers and directors breached their fiduciary duties to the

Company by making or causing to be made alleged misstatements about the Company’s actual and expected

financial performance while certain officers and directors sold Company stock and by allowing the Company to

be sued in the shareholder class action. The derivative plaintiff seeks unspecified damages and disgorgement of

profits on the sale of Company stock. On July 25, 2001, the Court entered a stipulation and order abating the

action until further notice. On or about February 11, 2003, the parties stipulated to an order vacating the order of

abatement. On February 14, 2003, the derivative plaintiff filed a first amended complaint reiterating and

expanding upon his original allegation, and naming additional officers and directors as defendants. On March 31,

2003, the Company filed a motion to dismiss the first amended complaint for failure to make or excuse a demand

on the Company’s Board of Directors. The Company’s motion to dismiss was denied by the Court on June 30,

2003. Based on the available information we do not currently anticipate that the action will have a material

financial impact. We believe the claims are without merit, and we intend to vigorously defend against them.

Another related shareholder derivative lawsuit, Lendman v. Knight, et al., CV-01-1153-AS, was filed in the

U.S. District Court for the District of Oregon on July 26, 2001. The federal derivative complaint is not materially

different from the original complaint in the state derivative action. It alleges substantially similar causes of action

and seeks substantially similar remedies. The federal derivative action was served on the Company and the

individual defendants on December 13, 2001 and was also stayed pending the outcome of In re NIKE, Inc.

Securities Litigation on December 13, 2001. On May 30, 2003, the Court entered an order of administrative

dismissal dismissing the case without prejudice.

In accordance with the Company’s Articles of Incorporation and Bylaws, and in accordance with indemnity

agreements between the Company and the directors and officers named in the above legal actions, the Company

has agreed to indemnify these individuals and assume their defense in these actions.

The Company and certain of its officers were named as defendants in a lawsuit, Kasky v. NIKE, Inc. et al.,

No. 994446, filed in 1998 in San Francisco County Superior Court. Plaintiff brought the action under the

California Business and Professions Code alleging that statements made by the Company in response to criticism

about labor practices in factories making its products were false or misleading. Plaintiff seeks injunctive relief

and restitution of profits earned from the alleged violations of the California Code. The claims were dismissed by

the Superior Court, with the court concluding that the alleged statements, if made, were protected speech as part

of a public debate under the First Amendment to the United States Constitution. Plaintiff appealed the Superior

Court ruling to the California Court of Appeals, which court affirmed the ruling of the lower court. Plaintiff

11