Nike 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NIKE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

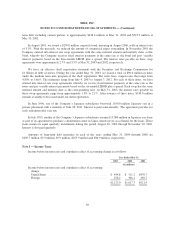

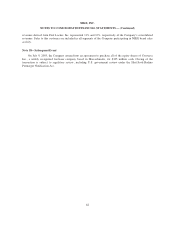

Results of hedges of selling and administrative expense are recorded together with those costs when the related

expense is recorded. Results of hedges of anticipated intercompany transactions are recorded in other income/

expense when the transaction occurs. Hedges of recorded balance sheet positions are recorded in other income/

expense currently together with the transaction gain or loss from the hedged balance sheet position. Net foreign

currency transaction gains and losses, which includes hedge results captured in revenues, cost of sales, selling

and administrative expense and other income/expense, were a $180.9 million loss, a $42.7 million gain, and a

$129.6 million gain for the years ended May 31, 2003, 2002, and 2001, respectively.

Premiums paid on options are initially recorded as deferred charges. The Company assesses effectiveness on

options based on the total cash flows method and records total changes in the options’ fair value to other

comprehensive income to the degree they are effective.

As of May 31, 2003, $171.9 million of deferred net losses (net of tax) on both outstanding and matured

derivatives accumulated in other comprehensive income are expected to be reclassified to net income during the

next twelve months as a result of underlying hedged transactions also being recorded in net income. Actual

amounts ultimately reclassified to net income are dependent on the exchange rates in effect when derivative

contracts that are currently outstanding mature. As of May 31, 2003, the maximum term over which the

Company is hedging exposures to the variability of cash flows for all forecasted and recorded transactions is

18 months.

The Company formally assesses, both at the hedge’s inception and on an ongoing basis, whether the

derivatives that are used in hedging transactions have been highly effective in offsetting changes in the cash

flows of hedged items and whether those derivatives may be expected to remain highly effective in future

periods. When it is determined that a derivative is not, or has ceased to be, highly effective as a hedge, the

Company discontinues hedge accounting prospectively.

The Company discontinues hedge accounting prospectively when (1) it determines that the derivative is no

longer highly effective in offsetting changes in the cash flows of a hedged item (including hedged items such as

firm commitments or forecasted transactions); (2) the derivative expires or is sold, terminated, or exercised; (3) it

is no longer probable that the forecasted transaction will occur; or (4) management determines that designating

the derivative as a hedging instrument is no longer appropriate.

When the Company discontinues hedge accounting because it is no longer probable that the forecasted

transaction will occur in the originally expected period, the gain or loss on the derivative remains in accumulated

other comprehensive income and is reclassified to net income when the forecasted transaction affects net income.

However, if it is probable that a forecasted transaction will not occur by the end of the originally specified time

period or within an additional two-month period of time thereafter, the gains and losses that were accumulated in

other comprehensive loss will be recognized immediately in net income. In all situations in which hedge

accounting is discontinued and the derivative remains outstanding, the Company will carry the derivative at its

fair value on the balance sheet, recognizing future changes in the fair value in current-period net income. Any

hedge ineffectiveness is recorded in current-period net income. Effectiveness for cash flow hedges is assessed

based on forward rates.

For the year ended May 31, 2003 the Company recorded in other income/expense an insignificant loss

representing the total ineffectiveness of all derivatives. An insignificant gain was recorded in other income/

expense for the year ended May 31, 2002. Net income for each of the years ended May 31, 2003 and 2002 was

not materially affected due to discontinued hedge accounting.

57