Nike 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

computer equipment and software related to our supply chain initiative and continued investment in NIKE-

owned retail stores. Spending for both of these activities declined in fiscal 2003 as compared to fiscal 2002.

Additionally, fiscal 2002 spending included our acquisition of all of the assets and substantially all of the

liabilities of Hurley International LLC, an action sports and youth lifestyle brand company. Costs incurred for

distribution center projects increased in fiscal 2003, the largest project being construction of a new storage

building in Japan, with scheduled opening in the second half of fiscal 2004. During fiscal 2004, we will continue

to make investments in systems improvements (most notably the supply chain initiative), retail expansion, and

our worldwide distribution center facilities. Additionally, during the first quarter of fiscal 2004, we entered into

an agreement to purchase Converse Inc., discussed further below.

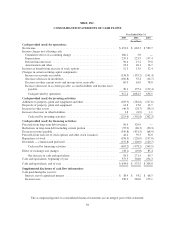

Cash used by financing activities in fiscal 2003 was $605.2 million, up from $478.2 million in the prior

year. This amount included uses of cash for dividends to shareholders, a net reduction in debt, and share

repurchases. These uses of cash were partially offset by proceeds from the exercise of employee stock options.

The share repurchases were part of a $1.0 billion share repurchase program that began in fiscal 2001, after

completion of a four-year, $1.0 billion program in fiscal 2000. In fiscal 2003, we repurchased 4.0 million shares

of NIKE’s Class B common stock for $191.0 million. To date, under the current program, we have purchased a

total of 12.3 million shares of NIKE’s Class B common stock for $585.7 million. We expect to continue to fund

the current program from operating cash flow. The timing and the ultimate amount of shares purchased under the

program will be dictated by our capital needs and stock market conditions.

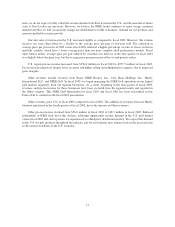

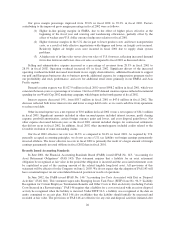

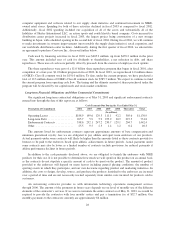

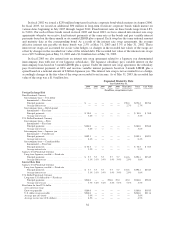

Long-term Financial Obligations and Other Commercial Commitments

Our significant long-term contractual obligations as of May 31, 2003 and significant endorsement contracts

entered into through the date of this report are as follows:

Cash Payments Due During the Year Ended May 31,

Description of Commitment 2004 2005 2006 2007 2008 Thereafter Total

(In millions)

Operating Leases ................. $188.9 149.6 129.5 111.1 92.2 505.6 $1,176.9

Long-term Debt .................. 205.7 5.9 5.9 255.9 30.9 227.5 731.8

Endorsement Contracts ............ 338.6 292.1 247.2 230.7 129.1 204.7 1,442.4

Other .......................... 25.5 9.5 2.5 1.4 1.2 0.2 40.3

The amounts listed for endorsement contracts represent approximate amounts of base compensation and

minimum guaranteed royalty fees we are obligated to pay athlete and sport team endorsers of our products.

Actual payments under some contracts will likely be higher than the amounts listed as these contracts provide for

bonuses to be paid to the endorsers based upon athletic achievements in future periods. Actual payments under

some contracts may also be lower as a limited number of contracts include provisions for reduced payments if

athlete performance declines in future periods.

In addition to the cash payments disclosed above, we are obligated to furnish the endorsers with NIKE

products for their use. It is not possible to determine how much we will spend on this product on an annual basis

as the contracts do not stipulate a specific amount of cash to be spent on the product. The amount of product

provided to the endorsers will depend on many factors including general playing conditions, the number of

sporting events in which they participate, and our own decisions regarding product and marketing initiatives. In

addition, the costs to design, develop, source, and purchase the products furnished to the endorsers are incurred

over a period of time and are not necessarily tracked separately from similar costs incurred for products sold to

customers.

An outsourcing contractor provides us with information technology operations management services

through 2006. The amount of the payments in future years depends on our level of monthly use of the different

elements of the contractor’s services. If we were to terminate the entire contract as of May 31, 2003, we would be

required to provide the contractor with four months’ notice and pay a termination fee of $32.7 million. Our

monthly payments to the contractor currently are approximately $6 million.

28