Nike 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

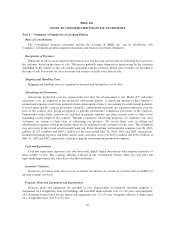

NIKE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

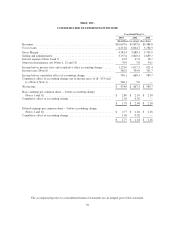

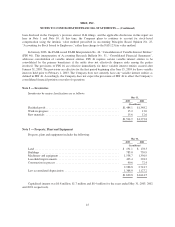

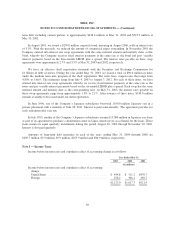

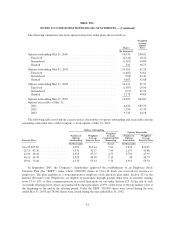

If the Company had accounted for these stock options issued to employees in accordance with FAS 123, the

Company’s pro forma net income and pro forma earnings per share (EPS) would have been reported as follows:

Year Ended May 31,

2003 2002 2001

(In millions)

Net income as reported .......................................... $474.0 $663.3 $589.7

Add: Stock-based compensation expense included in reported net income,

netoftax................................................... — — 0.8

Deduct: Total stock-based employee compensation expense under fair

value based method for all awards, net of tax ...................... (42.2) (36.1) (30.7)

Proformanetincome ........................................... $431.8 $627.2 $559.8

Earnings per Share:

Basic — as reported .......................................... $ 1.79 $ 2.48 $ 2.18

Basic — pro forma ........................................... $ 1.63 $ 2.34 $ 2.07

Diluted — as reported ........................................ $ 1.77 $ 2.44 $ 2.16

Diluted—proforma ......................................... $ 1.62 $ 2.30 $ 2.05

The pro forma effects of applying FAS 123 may not be representative of the effects on reported net income

and earnings per share for future years since options vest over several years and additional awards are made each

year.

Income Taxes

United States income taxes are provided currently on financial statement earnings of non-U.S. subsidiaries

expected to be repatriated. The Company determines annually the amount of undistributed non-U.S. earnings to

invest indefinitely in its non-U.S. operations. The Company accounts for income taxes using the asset and

liability method. This approach requires the recognition of deferred tax assets and liabilities for the expected

future tax consequences of temporary differences between the carrying amounts and the tax bases of other assets

and liabilities. See Note 8 for further discussion.

Earnings Per Share

Basic earnings per common share is calculated by dividing net income by the weighted average number of

common shares outstanding during the year. Diluted earnings per common share is calculated by adjusting

weighted average outstanding shares, assuming conversion of all potentially dilutive stock options and awards.

See Note 11 for further discussion.

Management Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires

management to make estimates, including estimates relating to assumptions that affect the reported amounts of

assets and liabilities and disclosure of contingent assets and liabilities at the date of financial statements and the

reported amounts of revenues and expenses during the reporting period. Actual results could differ from these

estimates.

43