Nike 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

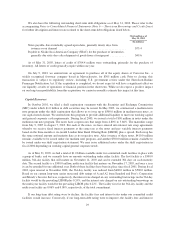

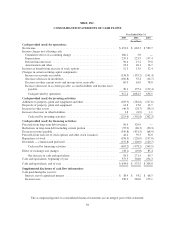

In fiscal 2002 we issued a $250 million long-term fixed-rate corporate bond which matures in August 2006.

In fiscal 2003, we issued an additional $90 million in long-term fixed-rate corporate bonds which mature on

various dates beginning in July 2007 through August 2012. Fixed interest rates on these bonds range from 4.8%

to 5.66%. For each of these bonds issued in fiscal 2002 and fiscal 2003, we have entered into interest rate swap

agreements whereby we receive fixed interest payments at the same rate as the bonds and pay variable interest

payments based on the three-month or six-month LIBOR plus a spread. Each swap has the same notional amount

and maturity date as the corresponding bond. As a result of the interest rate swap agreements, the average

effective interest rate payable on these bonds was 2.5% at May 31, 2003 and 3.3% at May 31, 2002. These

interest rate swaps are accounted for as fair value hedges, so changes in the recorded fair values of the swaps are

offset by changes in the recorded fair value of the related debt. The recorded fair value of the interest rate swaps

was a $25.5 million gain at May 31, 2003 and a $1.8 million loss at May 31, 2002.

In fiscal 2003 we also entered into an interest rate swap agreement related to a Japanese yen denominated

intercompany loan with one of our Japanese subsidiaries. The Japanese subsidiary pays variable interest on the

intercompany loan based on 3-month LIBOR plus a spread. Under the interest rate swap agreement, the subsidiary

pays fixed interest payments at 0.8% and receives variable interest payments based on 3-month LIBOR plus a

spread based on a notional amount of 8 billion Japanese yen. This interest rate swap is not accounted for as a hedge,

accordingly changes in the fair value of the swap are recorded to net income. As of May 31, 2003, the recorded fair

value of the swap was a $1.0 million loss.

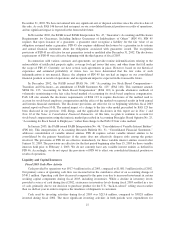

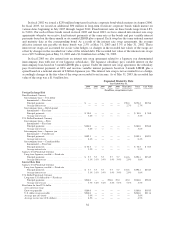

Expected Maturity Date

Year Ended May 31,

2004 2005 2006 2007 2008 Thereafter Total Fair Value

(In millions, except interest rates)

Foreign Exchange Risk

Euro Functional Currency

Intercompany loan — U.S. dollar

denominated — Fixed rate

Principalpayments ................................ $ — — — — — 270.4 $270.4 $270.4

Average interest rate ............................... — — — — — 2.7% 2.7%

Intercompany loan — British pound

denominated — Fixed rate

Principalpayments ................................ $ 30.0 — — — — — $ 30.0 $ 30.0

Average interest rate ............................... 3.4% — — — — — 3.4%

U.S. Dollar Functional Currency

Intercompany loans — Euro

denominated — Fixed rate

Principalpayments ................................ $186.0 — — — — — $186.0 $186.0

Average interest rate ............................... 5.6% — — — — — 5.6%

Intercompany loan — Japanese yen

denominated — Variable rate

Principalpayments ................................ $189.1 — — — — — $189.1 $189.1

Average interest rate ............................... 0.4% — — — — — 0.4%

Intercompany loan — Canadian dollar

denominated — Fixed rate

Principalpayments ................................ $ 36.3 — — — — — $ 36.3 $ 36.3

Average interest rate ............................... 3.5% — — — — — 3.5%

Japanese Yen Functional Currency

Long-term Japanese yen debt — Fixed rate

Principalpayments ................................ $ 5.7 5.7 5.7 5.7 5.7 161.6 $190.1 $234.5

Average interest rate ............................... 3.3% 3.3% 3.4% 3.4% 3.4% 2.9% 3.0%

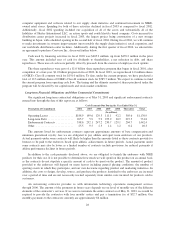

Interest Rate Risk

Japanese Yen Functional Currency

Long-term Japanese yen debt — Fixed rate

Principalpayments ................................ $ 5.7 5.7 5.7 5.7 5.7 161.6 $190.1 $234.5

Average interest rate ............................... 3.3% 3.3% 3.4% 3.4% 3.4% 2.9% 3.0%

U.S. Dollar Functional Currency

Long-term U.S. dollar debt — Fixed rate

Principalpayments ................................ $200.0 — — 250.0 25.0 65.0 $540.0 $582.2

Average interest rate ............................... 5.7% 5.4% 5.4% 5.4% 5.5% 5.5% 5.5%

Fixed euro for fixed U.S. dollar

cross-currency swap

Euroswappayable .................................. $186.0 — — — — — $186.0 $193.5

U.S. dollar swap receivable ........................... $200.0 — — — — — $200.0 $211.6

Average pay rate (euro) .............................. 5.6% — — — — — 5.6%

Average receive rate (U.S. dollars) ...................... 6.5% — — — — — 6.5%

32