Nike 2003 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NIKE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Fair Value Hedges

The Company is also exposed to the risk of changes in the fair value of certain fixed-rate debt attributable to

changes in interest rates. Derivatives currently used by the Company to hedge this risk are receive-fixed, pay-

variable interest rate swaps.

Substantially all interest rate swap agreements are designated as fair value hedges of the related long-term

debt and meet the shortcut method requirements under FAS 133. Accordingly, changes in the fair values of the

interest rate swap agreements are exactly offset by changes in the fair value of the underlying long-term debt. No

ineffectiveness has been recorded to net income related to interest rate swaps designated as fair value hedges for

the years ended May 31, 2003 and 2002.

During the year ended May 31, 2003 we also entered into an interest rate swap agreement related to a

Japanese yen denominated intercompany loan with one of our Japanese subsidiaries. The Japanese subsidiary

pays variable interest on the intercompany loan based on 3-month LIBOR plus a spread. Under the interest rate

swap agreement, the subsidiary pays fixed interest payments at 0.8% and receives variable interest payments

based on 3-month LIBOR plus a spread based on a notional amount of 8 billion Japanese yen. This interest rate

swap is not accounted for as a hedge, accordingly changes in the fair value of the swap are recorded to net

income. As of May 31, 2003, the recorded fair value of the swap was a $1.0 million loss.

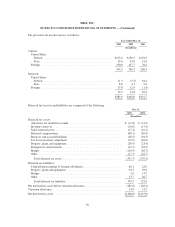

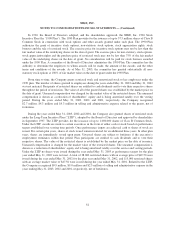

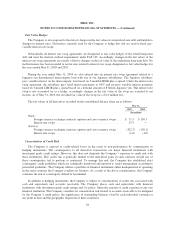

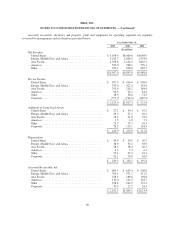

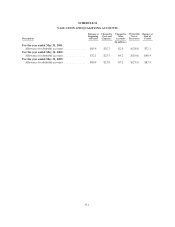

The fair values of all derivatives recorded on the consolidated balance sheet are as follows:

May 31,

2003 2002

(In millions)

Gains:

Foreign currency exchange contracts, options and cross-currency swaps . . . $ 71.5 $ 130.3

Interest rate swaps ............................................. 25.5 —

(Losses):

Foreign currency exchange contracts, options and cross-currency swaps . . . (322.7) (130.1)

Interest rate swaps ............................................. (1.0) (1.8)

Concentration of Credit Risk

The Company is exposed to credit-related losses in the event of non-performance by counterparties to

hedging instruments. The counterparties to all derivative transactions are major financial institutions with

investment grade credit ratings. However, this does not eliminate the Company’s exposure to credit risk with

these institutions. This credit risk is generally limited to the unrealized gains in such contracts should any of

these counterparties fail to perform as contracted. To manage this risk, the Company has established strict

counterparty credit guidelines which are continually monitored and reported to senior management according to

prescribed guidelines. The Company utilizes a portfolio of financial institutions either headquartered or operating

in the same countries the Company conducts its business. As a result of the above considerations, the Company

considers the risk of counterparty default to be minimal.

In addition to hedging instruments, the Company is subject to concentrations of credit risk associated with

cash and equivalents and accounts receivable. The Company places cash and equivalents with financial

institutions with investment grade credit ratings and, by policy, limits the amount of credit exposure to any one

financial institution. The Company considers its concentration risk related to accounts receivable to be mitigated

by the Company’s credit policy, the significance of outstanding balances owed by each individual customer at

any point in time and the geographic dispersion of these customers.

58