Nike 2003 Annual Report Download - page 20

Download and view the complete annual report

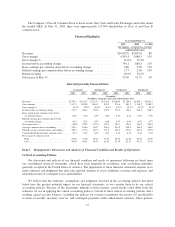

Please find page 20 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We take a conservative approach in determining the amount of foreign earnings to declare as reinvested

offshore. As required by U.S. generally accepted accounting principles, the presumption is that such earnings will

be repatriated in the future. We carefully review all factors that drive the ultimate disposition of such foreign

earnings, and apply stringent standards to overcoming the presumption of repatriation. Despite this conservative

approach, because the determination involves our future plans and expectations of future events, the possibility

exists that amounts declared as indefinitely reinvested offshore may ultimately be repatriated. For instance, the

actual cash needs of our U.S. entities may exceed our current expectations, or the actual cash needs of our foreign

entities may be less than our current expectations. This would result in additional income tax expense in the year

we determined that amounts were no longer indefinitely reinvested offshore. Conversely, our conservative

approach may result in accumulated foreign earnings (for which U.S. income taxes have been provided) being

determined in the future to be indefinitely reinvested offshore. In this case, our income tax expense would be

reduced in the year of such determination.

On an interim basis, we estimate what our effective tax rate will be for the full fiscal year and record a

quarterly income tax provision in accordance with the anticipated annual rate. As the fiscal year progresses, we

continually refine our estimate based upon actual events and earnings by jurisdiction during the year. This

continual estimation process periodically results in a change to our expected effective tax rate for the fiscal year.

When this occurs, we adjust the income tax provision during the quarter in which the change in estimate occurs

so that the year-to-date provision equals the expected annual rate.

Other Contingencies

In the ordinary course of business, we are involved in legal proceedings regarding contractual and

employment relationships, product liability claims, trademark rights, and a variety of other matters. We record

contingent liabilities resulting from claims against us when it is probable that a liability has been incurred and the

amount of the loss is reasonably estimable. We disclose contingent liabilities when there is a reasonable

possibility that the ultimate loss will materially exceed the recorded liability. Estimating probable losses requires

analysis of multiple factors, in some cases including judgments about the potential actions of third party

claimants and courts. Therefore, actual losses in any future period are inherently uncertain. Currently, we do not

believe that any of our pending legal proceedings or claims will have a material impact on our financial position

or results of operations. However, if actual or estimated probable future losses exceed our recorded liability for

such claims, we would record additional charges as other expense during the period in which the actual loss or

change in estimate occurred.

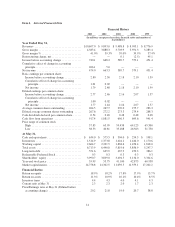

Results of Operations

Fiscal 2003 Compared to Fiscal 2002

• Revenues increased 8% to $10.7 billion, the highest annual revenues in the history of NIKE.

• Income before the cumulative effect of an accounting change increased to $740.1 million from

$668.3 million in the prior year, an increase of 11%. After the effect of the accounting change, net income

declined 29% from $663.3 million to $474.0 million.

• Diluted earnings per share before the effect of the accounting change increased by 13%, from $2.46 to

$2.77. After the effect of the accounting change, diluted earnings per share declined 27%.

• Gross margins increased as a percentage of revenues from 39.3% to 41.0% in fiscal 2003.

• Selling and administrative expense increased as a percentage of revenues to 29.3% from 28.5% in the prior

year.

Revenue growth in our international regions drove the 8% increase in consolidated revenues in fiscal 2003

as compared to fiscal 2002. Changes in currency exchange rates, primarily the euro, were responsible for 4% of

the consolidated revenue growth.

19