Nike 2003 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NIKE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

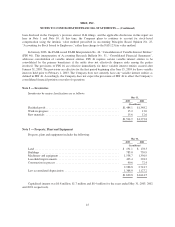

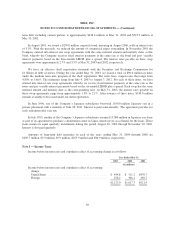

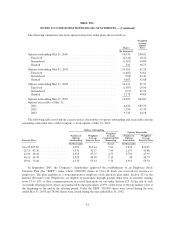

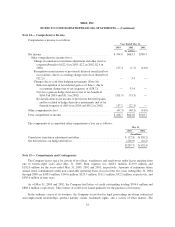

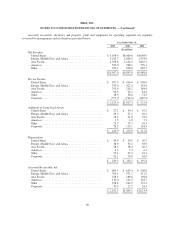

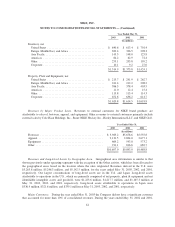

Note 14 — Comprehensive Income

Comprehensive income is as follows:

Year Ended May 31,

2003 2002 2001

(In millions)

Netincome ............................................... $474.0 $663.3 $589.7

Other comprehensive income (loss):

Change in cumulative translation adjustment and other (net tax

(expense)/benefit of ($22.4) in 2003, $2.2 in 2002, $2.4 in

2001) .............................................. 127.4 (1.5) (41.0)

Recognition in net income of previously deferred unrealized loss

on securities, due to accounting change (net of tax (benefit) of

($2.2)) ............................................. — 3.4 —

Changes due to cash flow hedging instruments (Note 16):

Initial recognition of net deferred gain as of June 1, due to

accounting change (net of tax (expense) of ($28.7)) ....... — 53.4 —

Net (loss) gain on hedge derivatives (net of tax benefit of

$160.8 in 2003 and $31.5 in 2002) ..................... (311.9) (73.3) —

Reclassification to net income of previously deferred (gains)

and loss related to hedge derivative instruments (net of tax

(benefit)/expense of ($65.6) in 2003 and $10.2 in 2002) .... 137.2 (22.3) —

Othercomprehensiveloss .................................... (47.3) (40.3) (41.0)

Totalcomprehensiveincome ................................. $426.7 $623.0 $548.7

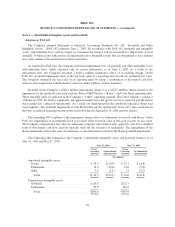

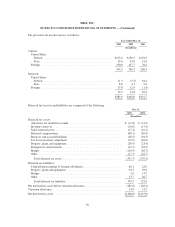

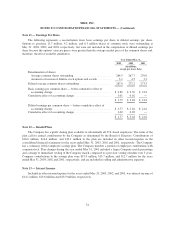

The components of accumulated other comprehensive loss are as follows:

May 31,

2003 2002

(In millions)

Cumulative translation adjustment and other ............................. $ (22.8) $(150.2)

Net deferred loss on hedge derivatives .................................. (216.9) (42.2)

$(239.7) $(192.4)

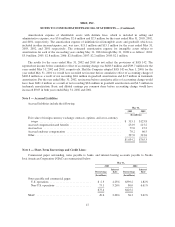

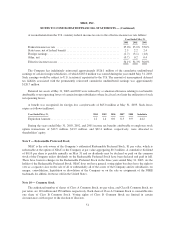

Note 15 — Commitments and Contingencies

The Company leases space for certain of its offices, warehouses and retail stores under leases expiring from

one to twenty-eight years after May 31, 2003. Rent expense was $183.2 million, $159.9 million and

$152.0 million for the years ended May 31, 2003, 2002 and 2001, respectively. Amounts of minimum future

annual rental commitments under non-cancelable operating leases in each of the five years ending May 31, 2004

through 2008 are $188.9 million, $149.6 million, $129.5 million, $111.1 million, $92.2 million, respectively, and

$505.6 million in later years.

As of May 31, 2003 and 2002, the Company had letters of credit outstanding totaling $704.4 million and

$808.4 million, respectively. These letters of credit were issued primarily for the purchase of inventory.

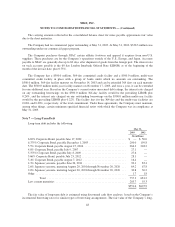

In the ordinary course of its business, the Company is involved in legal proceedings involving contractual

and employment relationships, product liability claims, trademark rights, and a variety of other matters. The

55