Nike 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NIKE, INC.

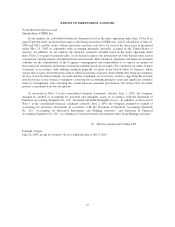

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Impairment of Long-Lived Assets

Effective June 1, 2002, the Company adopted the provisions of Statement of Financial Accounting

Standards (SFAS) No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets” (FAS 144),

which did not have an impact on the Company’s consolidated financial position or results of operations. In

accordance with FAS 144, the Company estimates the future undiscounted cash flows to be derived from an asset

to assess whether or not a potential impairment exists when events or circumstances indicate the carrying value

of a long-lived asset may be impaired. If the carrying value exceeds our estimate of future undiscounted cash

flows, we then calculate the impairment as the excess of the carrying value of the asset over our estimate of its

fair market value.

Identifiable Intangible Assets and Goodwill

In accordance with SFAS No. 142 “Goodwill and Other Intangible Assets” (FAS 142), goodwill and

intangible assets with indefinite lives are no longer being amortized but instead are being measured for

impairment at least annually, or when events indicate that an impairment exists. As required by FAS 142, in the

Company’s impairment test of goodwill, we compare the fair value of the applicable reporting unit to its carrying

value. If the carrying value of the reporting unit exceeds the estimate of fair value, we calculate the impairment

as the excess of the carrying value of goodwill over its implied fair value. In the impairment tests for indefinite-

lived intangible assets, we compare the estimated fair value of the indefinite-lived intangible assets to the

carrying value. If the carrying value exceeds the estimate of fair value, we calculate impairment as the excess of

the carrying value over the estimate of fair value. See Note 4 for discussion of the Company’s adoption of

FAS 142.

Intangible assets that are determined to have definite lives are amortized over their useful lives and are

measured for impairment only when events or circumstances indicate the carrying value may be impaired in

accordance with FAS 144 discussed above.

Foreign Currency Translation and Foreign Currency Transactions

Adjustments resulting from translating foreign functional currency financial statements into U.S. dollars are

included in the foreign currency translation adjustment, a component of accumulated other comprehensive loss in

shareholders’ equity.

Transaction gains and losses generated by the effect of foreign exchange on recorded assets and liabilities

denominated in a currency different from the functional currency of the applicable Company entity are recorded

in other income/expense currently.

Accounting for Derivatives and Hedging Activities

The Company uses derivative financial instruments to limit exposure to changes in foreign currency

exchange rates and interest rates. The Company accounts for derivatives pursuant to SFAS No. 133, “Accounting

for Derivative Instruments and Hedging Activities,” as amended and interpreted (FAS 133), which was adopted

on June 1, 2001. FAS 133 establishes accounting and reporting standards for derivative instruments and requires

that all derivatives be recorded at fair value on the balance sheet. Changes in the fair value of derivative financial

instruments are either recognized in other comprehensive income (a component of shareholders equity) or net

income depending on whether the derivative is being used to hedge changes in cash flows or fair value.

In accordance with the transition provisions, the Company recorded a one-time transition adjustment as of

June 1, 2001 on both the consolidated statement of income and the consolidated balance sheet. The transition

41