Nike 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

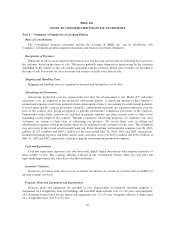

NIKE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The carrying amounts reflected in the consolidated balance sheet for notes payable approximate fair value

due to the short maturities.

The Company had no commercial paper outstanding at May 31, 2003. At May 31, 2002, $338.3 million was

outstanding under our commercial paper program.

The Company purchases through NIAC certain athletic footwear and apparel it acquires from non-U.S.

suppliers. These purchases are for the Company’s operations outside of the U.S., Europe, and Japan. Accounts

payable to NIAC are generally due up to 60 days after shipment of goods from the foreign port. The interest rate

on such accounts payable is the 60 day London Interbank Offered Rate (LIBOR) as of the beginning of the

month of the invoice date, plus 0.75%.

The Company has a $500.0 million, 364-day committed credit facility and a $500.0 million, multi-year

committed credit facility in place with a group of banks under which no amounts are outstanding. The

$500.0 million, 364-day facility matures on November 14, 2003 and can be extended 364 days on each maturity

date. The $500.0 million multi-year facility matures on November 17, 2005, and once a year, it can be extended

for one additional year. Based on the Company’s current senior unsecured debt ratings, the interest rate charged

on any outstanding borrowings on the $500.0 million 364-day facility would be the prevailing LIBOR plus

0.24%, and the interest rate charged on any outstanding borrowings on the $500.0 million multi-year facility

would be the prevailing LIBOR plus 0.22%. The facility fees for the 364-day and the multi-year facilities are

0.06% and 0.08%, respectively, of the total commitment. Under these agreements, the Company must maintain,

among other things, certain minimum specified financial ratios with which the Company was in compliance at

May 31, 2003.

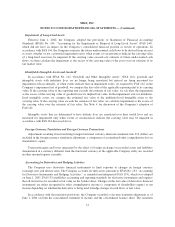

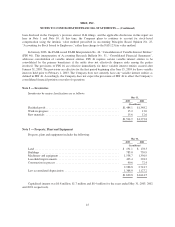

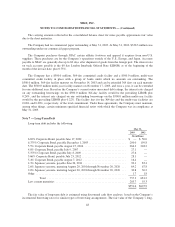

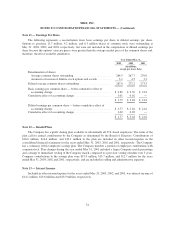

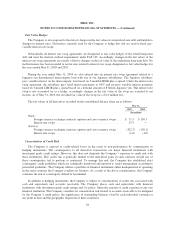

Note 7 — Long-Term Debt

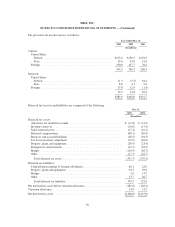

Long-term debt includes the following:

May 31,

2003 2002

(In millions)

6.69% Corporate Bond, payable June 17, 2002 .............................. $ — $ 50.0

6.375% Corporate Bond, payable December 1, 2003 .......................... 200.0 199.8

5.5% Corporate Bond, payable August 15, 2006 ............................. 266.3 248.2

4.8% Corporate Bond, payable July 9, 2007 ................................. 27.1 —

5.375% Corporate Bond, payable July 8, 2009 ............................... 27.6 —

5.66% Corporate Bond, payable July 23, 2012 ............................... 28.1 —

5.4% Corporate Bond, payable August 7, 2012 .............................. 16.4 —

4.3% Japanese yen note, payable June 26, 2011 .............................. 90.1 83.4

2.6% Japanese yen note, maturing August 20, 2001 through November 20, 2020 . . . 69.2 67.8

2.0% Japanese yen note, maturing August 20, 2001 through November 20, 2020 . . . 30.8 30.2

Other ............................................................... 1.7 1.8

Total ....................................................... 757.3 681.2

Less current maturities ................................................. 205.7 55.3

$551.6 $625.9

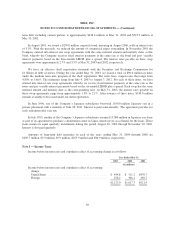

The fair value of long-term debt is estimated using discounted cash flow analyses, based on the Company’s

incremental borrowing rates for similar types of borrowing arrangements. The fair value of the Company’s long-

48