Nike 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NIKE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

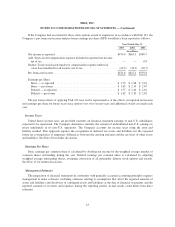

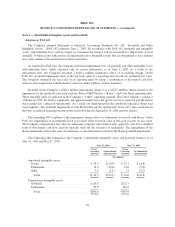

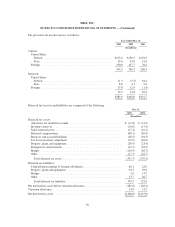

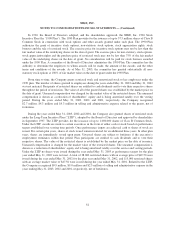

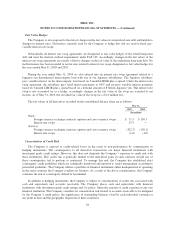

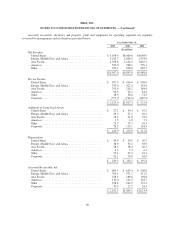

The provision for income taxes is as follows:

Year Ended May 31,

2003 2002 2001

(In millions)

Current:

United States

Federal ............................................... $125.6 $156.5 $158.5

State ................................................. 33.6 32.0 31.6

Foreign ................................................. 190.0 147.7 76.2

349.2 336.2 266.3

Deferred:

United States

Federal ............................................... 11.3 (3.3) 64.2

State ................................................. 8.6 3.3 2.6

Foreign ................................................. 13.8 12.8 (1.4)

33.7 12.8 65.4

$382.9 $349.0 $331.7

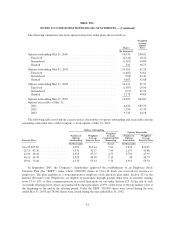

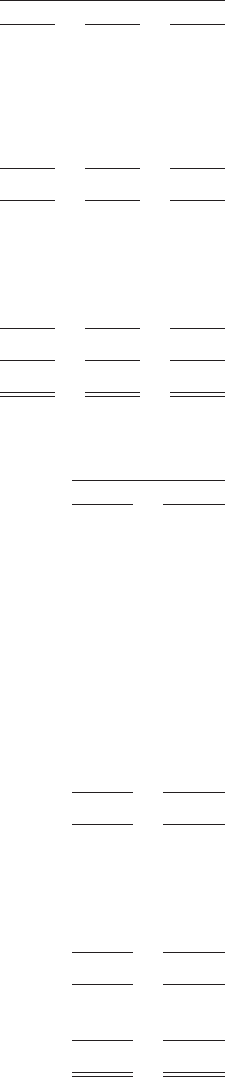

Deferred tax (assets) and liabilities are comprised of the following:

May 31,

2003 2002

(In millions)

Deferred tax assets:

Allowance for doubtful accounts .................................... $ (11.8) $ (14.5)

Inventory reserves ................................................ (10.0) (17.4)

Sales return reserves .............................................. (27.4) (22.1)

Deferred compensation ............................................ (68.1) (49.0)

Reserves and accrued liabilities ..................................... (28.5) (38.5)

Tax basis inventory adjustment ..................................... (15.9) (16.0)

Property, plant, and equipment ...................................... (28.9) (23.4)

Foreign loss carryforwards ......................................... (32.5) (39.9)

Hedges ........................................................ (110.9) (26.7)

Other .......................................................... (17.7) (22.7)

Total deferred tax assets ......................................... (351.7) (270.2)

Deferred tax liabilities:

Undistributed earnings of foreign subsidiaries .......................... 60.1 22.0

Property, plant and equipment ...................................... 94.3 59.6

Hedges ........................................................ 2.6 13.7

Other .......................................................... 13.7 26.7

Total deferred tax liabilities ...................................... 170.7 122.0

Net deferred tax asset before valuation allowance ......................... (181.0) (148.2)

Valuation allowance ................................................ 13.0 13.2

Net deferred tax asset ............................................... $(168.0) $(135.0)

50