Nike 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NIKE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

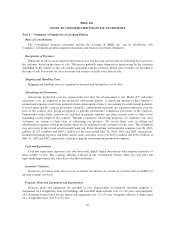

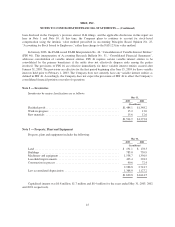

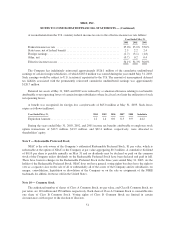

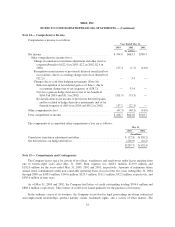

Amortization expense of identifiable assets with definite lives, which is included in selling and

administrative expense, was $3.6 million, $2.6 million and $2.5 million for the years ended May 31, 2003, 2002,

and 2001, respectively. The amortization expense of indefinite-lived intangible assets and goodwill, which was

included in other income/expense, net, was zero, $13.1 million and $13.1 million for the years ended May 31,

2003, 2002, and 2001 respectively. The estimated amortization expense for intangible assets subject to

amortization for each of the succeeding years ending May 31, 2004 through May 31, 2008 is as follows: 2004:

$3.0 million; 2005: $2.8 million; 2006: $2.8 million; 2007: $2.2 million; 2008: $2.1 million.

The results for the years ended May 31, 2002 and 2001 do not reflect the provisions of FAS 142. The

reported net income before cumulative effect of accounting change was $668.3 million and $589.7 million for the

years ended May 31, 2002 and 2001, respectively. Had the Company adopted FAS 142 on June 1, 2000, for the

year ended May 31, 2001 we would have recorded net income before cumulative effect of accounting change of

$602.8 million as a result of not recording $8.6 million in goodwill amortization and $4.5 million in trademark

amortization. For the year ended May 31, 2002, net income before cumulative effect of accounting change would

have been $681.4 million as a result of not recording $8.6 million in goodwill amortization and $4.5 million in

trademark amortization. Basic and diluted earnings per common share before accounting change would have

increased $0.05 in both years ended May 31, 2002 and 2001.

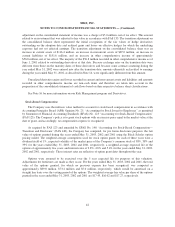

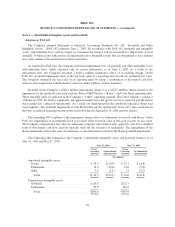

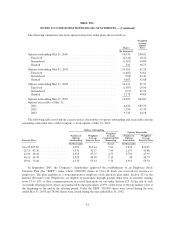

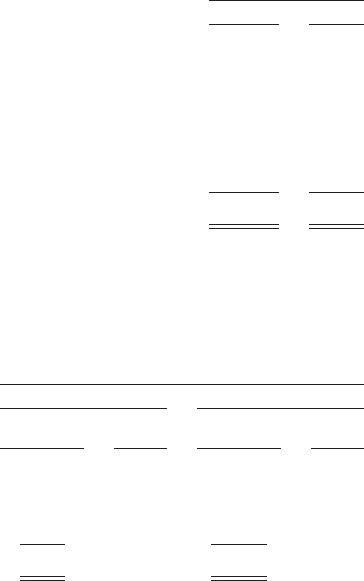

Note 5 — Accrued Liabilities

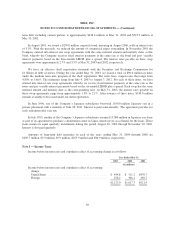

Accrued liabilities include the following:

May 31,

2003 2002

(In millions)

Fair value of foreign currency exchange contracts, options, and cross-currency

swaps ......................................................... $ 313.1 $123.8

Accrued compensation and benefits .................................... 254.9 215.2

Accrued tax ...................................................... 79.0 47.2

Accrued endorser compensation ...................................... 70.2 66.5

Other............................................................ 337.0 312.6

$1,054.2 $765.3

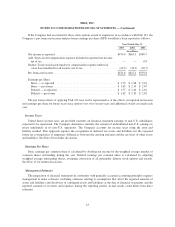

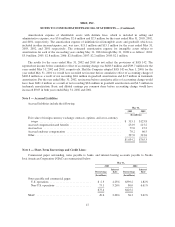

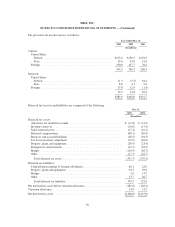

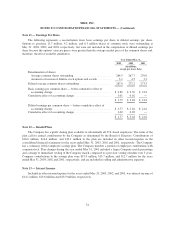

Note 6 — Short-Term Borrowings and Credit Lines:

Commercial paper outstanding, notes payable to banks, and interest-bearing accounts payable to Nissho

Iwai American Corporation (NIAC) are summarized below:

May 31,

2003 2002

Borrowings

Interest

Rate Borrowings

Interest

Rate

(In millions) (In millions)

Notes payable and commercial paper:

U.S. operations ............................. $ 2.3 4.25% $339.2 1.82%

Non-U.S. operations ......................... 73.1 5.26% 86.0 6.61%

$75.4 $425.2

NIAC ...................................... 49.6 2.06% 36.3 2.62%

47