Nike 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NIKE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

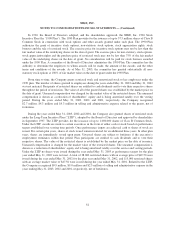

been disclosed in the Company’s previous annual 10-K filings, and the applicable disclosures in this report are

here in Note 1 and Note 10. At this time, the Company plans to continue to account for stock-based

compensation using the intrinsic value method prescribed in Accounting Principles Board Opinion No. 25,

“Accounting for Stock Issued to Employees,” rather than change to the FAS 123 fair value method.

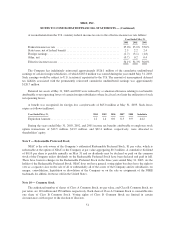

In January 2003, the FASB issued FASB Interpretation No. 46, “Consolidation of Variable Interest Entities”

(FIN 46). This interpretation of Accounting Research Bulletin No. 51, “Consolidated Financial Statements”,

addresses consolidation of variable interest entities. FIN 46 requires certain variable interest entities to be

consolidated by the primary beneficiary if the entity does not effectively disperse risks among the parties

involved. The provisions of FIN 46 are effective immediately for those variable interest entities created after

January 31, 2003. The provisions are effective for the first period beginning after June 15, 2003 for those variable

interests held prior to February 1, 2003. The Company does not currently have any variable interest entities as

defined in FIN 46. Accordingly, the Company does not expect the provisions of FIN 46 to affect the Company’s

consolidated financial position or results of operations.

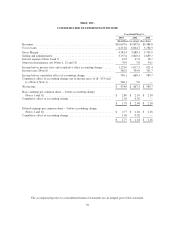

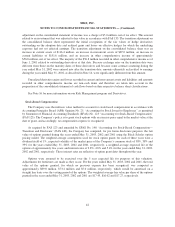

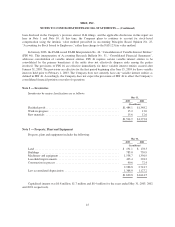

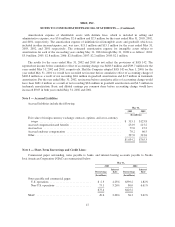

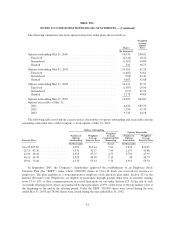

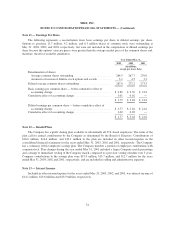

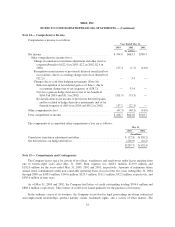

Note 2 — Inventories

Inventories by major classification are as follows:

May 31,

2003 2002

(In millions)

Finished goods ................................................... $1,484.1 $1,348.2

Work-in-progress ................................................ 15.2 13.0

Raw materials ................................................... 15.6 12.6

$1,514.9 $1,373.8

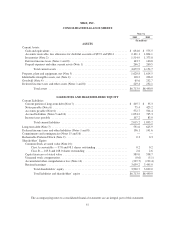

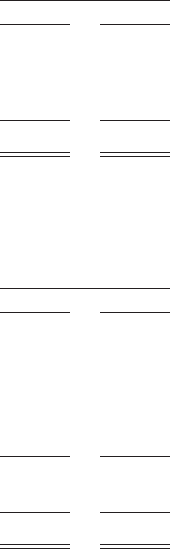

Note 3 — Property, Plant and Equipment

Property, plant and equipment includes the following:

May 31,

2003 2002

(In millions)

Land........................................................... $ 191.1 $ 178.3

Buildings ....................................................... 785.0 739.9

Machineryandequipment.......................................... 1,538.7 1,356.9

Leasehold improvements ........................................... 433.4 394.2

Construction in process ............................................ 40.6 72.4

2,988.8 2,741.7

Less accumulated depreciation ...................................... 1,368.0 1,127.2

$1,620.8 $1,614.5

Capitalized interest was $0.8 million, $1.7 million and $8.4 million for the years ended May 31, 2003, 2002

and 2001, respectively.

45