Nike 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NIKE, INC.

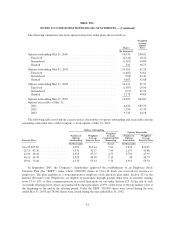

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

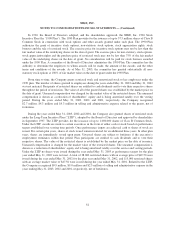

Company does not believe there are any pending legal proceedings that will have a material impact on the

Company’s financial position or results of operations.

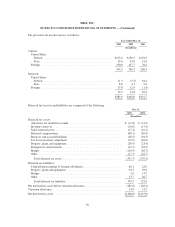

Note 16 — Risk Management and Derivatives

The Company is exposed to global market risks, including the effect of changes in foreign currency

exchange rates and interest rates. The Company uses derivatives to manage financial exposures that occur in the

normal course of business. The Company does not hold or issue derivatives for trading purposes.

The Company formally documents all relationships between hedging instruments and hedged items, as well

as its risk-management objective and strategy for undertaking hedge transactions. This process includes linking

all derivatives to either specific assets and liabilities on the balance sheet or specific firm commitments or

forecasted transactions.

Substantially all derivatives entered into by the Company are designated as either cash flow or fair value

hedges. All derivatives are recognized on the balance sheet at their fair value. Unrealized gain positions are

recorded as other current assets or other non-current assets, depending on the instrument’s maturity date.

Unrealized loss positions are recorded as accrued liabilities or other non-current liabilities. Changes in fair values

of outstanding cash flow hedge derivatives that are highly effective are recorded in other comprehensive income,

until net income is affected by the variability of cash flows of the hedged transaction. Fair value hedges are

recorded in net income and are offset by the change in fair value of the underlying asset or liability being hedged.

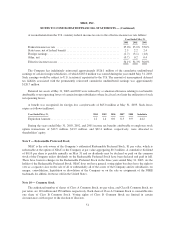

Cash Flow Hedges

The purpose of the Company’s foreign currency hedging activities is to protect the Company from the risk

that the eventual cash flows resulting from transactions in foreign currencies, including revenues, product costs,

selling and administrative expenses, and intercompany transactions, including intercompany borrowings, will be

adversely affected by changes in exchange rates. It is the Company’s policy to utilize derivatives to reduce

foreign exchange risks where internal netting strategies cannot be effectively employed.

Derivatives used by the Company to hedge foreign currency exchange risks are forward exchange contracts,

options and cross-currency swaps. These instruments protect against the risk that the eventual net cash inflows

and outflows from foreign currency denominated transactions will be adversely affected by changes in exchange

rates. The cross-currency swaps are used to hedge foreign currency denominated payments related to

intercompany loan agreements. Hedged transactions are denominated primarily in European currencies, Japanese

yen, Canadian dollars, Korean won, Mexican pesos, and Australian dollars. The Company hedges up to 100% of

anticipated exposures typically twelve months in advance but has hedged as much as 32 months in advance.

When intercompany loans are hedged, it is typically for their expected duration.

Substantially all foreign currency derivatives entered into by the Company qualify for and are designated as

foreign-currency cash flow hedges, including those hedging foreign currency denominated firm commitments.

Changes in fair values of outstanding cash flow hedge derivatives that are highly effective are recorded in

other comprehensive income, until net income is affected by the variability of cash flows of the hedged

transaction. In most cases amounts recorded in other comprehensive income will be released to net income some

time after the maturity of the related derivative. The consolidated statement of income classification of effective

hedge results is the same as that of the underlying exposure. Results of hedges of revenue and product costs are

recorded in revenue and cost of sales, respectively, when the underlying hedged transaction affects net income.

56