Nike 2003 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2003 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company’s Class B Common Stock is listed on the New York and Pacific Exchanges and trades under

the symbol NKE. At May 31, 2003, there were approximately 127,000 shareholders of Class A and Class B

common stock.

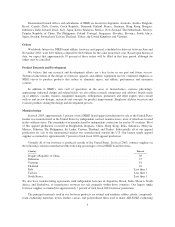

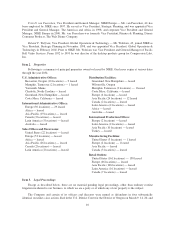

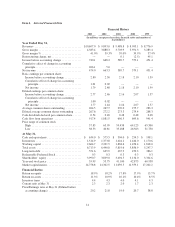

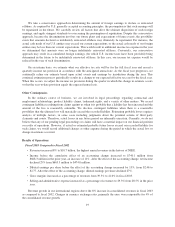

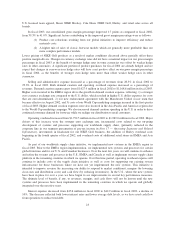

Financial Highlights

Year Ended May 31,

2003 2002 % CHG

(In millions, except per share data

and financial ratios)

Revenues ........................................................ $10,697.0 $9,893.0 8%

Grossmargin ..................................................... 4,383.4 3,888.3 13%

Grossmargin% ................................................... 41.0% 39.3%

Incomebeforeaccountingchange ..................................... 740.1 668.3 11%

Basic earnings per common share before accounting change ................ 2.80 2.50 12%

Diluted earnings per common share before accounting change .............. 2.77 2.46 13%

Returnonequity................................................... 18.9% 18.2%

Stock price at May 31 .............................................. 55.99 53.75 4%

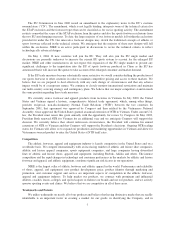

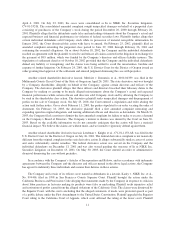

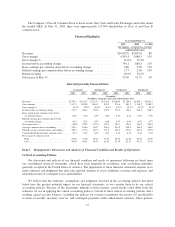

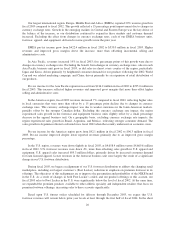

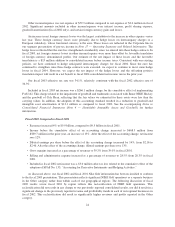

Selected Quarterly Financial Data

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

2003 2002 2003 2002 2003 2002 2003 2002

(Unaudited)

(In millions, except per share data and financial ratios)

Revenues.............................. $2,796.3 $2,613.7 $2,514.7 $2,336.8 $2,400.9 $2,260.3 $2,985.1 $2,682.2

Grossmargin........................... 1,157.1 1,028.9 1,010.1 895.4 976.0 883.5 1,240.2 1,080.5

Grossmargin%......................... 41.4% 39.4% 40.2% 38.3% 40.7% 39.1% 41.5% 40.3%

Incomebeforeaccountingchange .......... 217.2 204.2 152.0 129.3 124.7 126.3 246.2 208.5

Basic earnings per common share before

accountingchange..................... 0.82 0.76 0.57 0.48 0.47 0.47 0.93 0.78

Diluted earnings per common share before

accountingchange..................... 0.81 0.75 0.57 0.48 0.47 0.46 0.92 0.77

Netincome(loss) ....................... (48.9) 199.2 152.0 129.3 124.7 126.3 246.2 208.5

Average common shares outstanding ........ 265.3 268.6 264.7 268.1 263.9 268.4 264.0 266.9

Diluted average common shares outstanding . . 269.1 271.6 267.5 271.6 266.7 273.4 267.6 272.0

Cash dividends declared per common share . . . 0.12 0.12 0.14 0.12 0.14 0.12 0.14 0.12

Price range of common stock

High................................ 57.85 51.28 48.23 53.55 48.43 61.00 56.56 63.99

Low ................................ 40.50 40.81 38.53 42.26 41.19 52.31 45.51 52.75

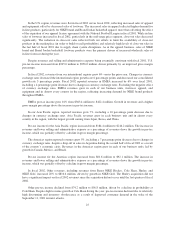

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Critical Accounting Policies

Our discussion and analysis of our financial condition and results of operations following are based upon

our consolidated financial statements, which have been prepared in accordance with accounting principles

generally accepted in the United States of America. The preparation of these financial statements requires us to

make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and

related disclosure of contingent assets and liabilities.

We believe that the estimates, assumptions and judgments involved in the accounting policies described

below have the greatest potential impact on our financial statements, so we consider these to be our critical

accounting policies. Because of the uncertainty inherent in these matters, actual results could differ from the

estimates we use in applying the critical accounting policies. Certain of these critical accounting policies affect

working capital account balances, including the policies for revenue recognition, the reserve for uncollectible

accounts receivable, inventory reserves, and contingent payments under endorsement contracts. These policies

15