NetSpend 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2011, 2010 and 2009

NOTE 13: SHARE BASED PAYMENT (Continued)

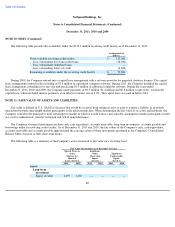

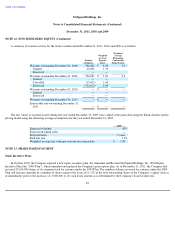

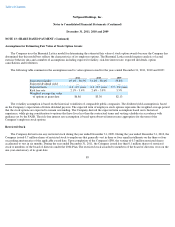

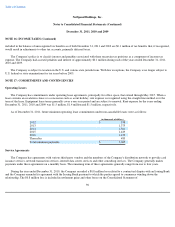

Activity related to the Company's restricted stock awards during the year ended December 31, 2011 is as follows:

Stock-Based Compensation Expense

During the years ended December 31, 2011, 2010 and 2009, the Company recorded total stock-based compensation expense of

$11.2 million, $7.3 million and $4.5 million, respectively.

As of December 31, 2011, the Company's outstanding options had a weighted average remaining contractual term of 6.9 years. As of

December 31, 2011, unrecognized compensation cost, net of estimated forfeitures, related to stock options amounted to $12.9 million and is

expected to be recognized over a weighted average period of 2.1 years. As of December 31, 2011, unrecognized stock-based compensation

cost, net of estimated forfeitures, related to restricted stock amounted to $1.6 million and is expected to be recognized over a weighted average

period of 2.4 years. The amount of unrecognized stock-based compensation will be affected by any future stock option or restricted stock

grants.

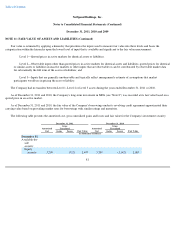

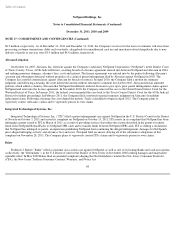

The Company considers the type of award, employee class and historical experience in estimating annual forfeiture rates. The following

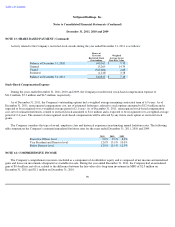

table summarizes the Company's estimated annualized forfeiture rates for the years ended December 31, 2011, 2010 and 2009:

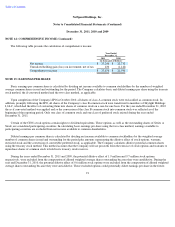

NOTE 14: COMPREHENSIVE INCOME

The Company's comprehensive income is included as a component of stockholders' equity and is composed of net income and unrealized

gains and losses on investments designated as available-for-sale. During the year ended December 31, 2011, the Company had an unrealized

gain of $0.4 million, net of tax, related to the difference between the fair value of its long-term investment in MFG of $2.5 million on

December 31, 2011 and $2.1 million on December 31, 2010.

90

Shares of

Unvested

Restricted Stock

Outstanding

Weighted

Average Grant

Date Fair Value

Balance at December 31, 2010

690,363

$

5.70

Granted

15,269

14.74

Vested

(363,606

)

4.68

Forfeited

(1,213

)

3.78

Balance at December 31, 2011

340,813

$

7.18

2011 2010 2009

Executive Officer level

9.0

%

9.0

%

8.0

%

Vice President and Director level

12.0

%

15.0

%

10.0

%

Below Director level

12.0

%

12.5

%

12.5

%