NetSpend 2011 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

Market Information

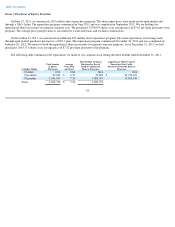

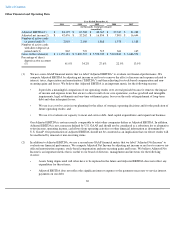

Our common stock has been listed on the NASDAQ stock market under the symbol "NTSP" since October 19, 2010. Prior to that date,

there was no public trading market for our common stock. Our initial public offering ("IPO") was priced at $11.00 per share. The following

table sets forth for the periods indicated the high and low sales prices per share of our common stock as reported on NASDAQ stock market.

On February 21, 2012, the last reported sales price of our common stock on the NASDAQ stock market was $9.61 per share and, as of

December 31, 2011, there were 173 holders of record of our common stock. Because many of our shares of common stock are held by brokers

and other institutions on behalf of stockholders, we are unable to estimate the total number of stockholders represented by the stockholders of

record.

Dividend Policy

We did not pay cash dividends on our common stock during the 2011 or 2010 and we do not expect to pay cash dividends on our common

stock for the foreseeable future. We did expend $32.7 million to repurchase 4,319,844 shares of common stock during 2011 and we have an

ongoing program pursuant to which we expect to purchase an additional $17.4 million of shares in 2012. Any future determination to pay cash

dividends on our common stock would be subject to the discretion of our board of directors and would depend upon various factors, including

our results of operations, financial condition and liquidity requirements, restrictions that may be imposed by applicable law and our contracts

and other factors deemed relevant by our board of directors. In addition, the terms of our credit facility currently restricts our ability to pay

dividends.

Unregistered Sales of Equity Securities

In August 2011, we created a new series of preferred stock consisting of 1,500,000 shares that are designated as "Series A Convertible

Preferred Stock" (the "Series A Preferred Stock"). The shares of Series A Preferred Stock are essentially identical to our Common Stock,

except that the Series A Preferred Stock has no voting rights other than as may be required by applicable law. Shares of Series A Preferred

Stock are convertible into Common Stock at the rate of ten shares of Common Stock for each share of Series A Preferred Stock; provided ,

however , that no holder of shares of Series A Preferred Stock may convert any of their shares into Common Stock if (i) upon completing such

conversion the holder, together with its affiliates, would own or control shares of Common Stock representing 24.9% or more of our

outstanding voting securities or (ii) such conversion would require prior approval or notice under any state law then applicable to us or our

subsidiaries.

26

High Low

Year ended December 31, 2011

Fourth Quarter

$

8.16

$

4.36

Third Quarter

$

10.09

$

3.90

Second Quarter

$

11.78

$

7.53

First Quarter

$

15.90

$

8.97

Year ended December 31, 2010

Fourth Quarter (beginning October 19)

$

16.21

$

11.02