NetSpend 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2011, 2010 and 2009

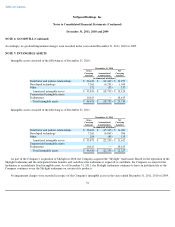

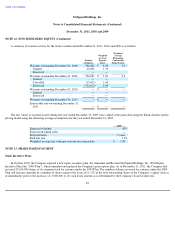

NOTE 7: INTANGIBLE ASSETS (Continued)

Amortization expense for the years ended December 31, 2011, 2010 and 2009 was $3.5 million, $3.2 million and $3.5 million,

respectively. As of December 31, 2011, estimated amortization expense for the next five years and thereafter was as follows:

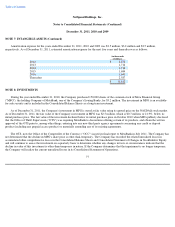

NOTE 8: INVESTMENTS

During the year ended December 31, 2010, the Company purchased 150,000 shares of the common stock of Meta Financial Group

("MFG"), the holding Company of MetaBank, one of the Company's Issuing Banks, for $3.2 million. The investment in MFG is an available-

for-sale security and is included in the Consolidated Balance Sheets as a long-term investment.

As of December 31, 2011, the Company's investment in MFG is stated at fair value using its quoted price on the NASDAQ stock market.

As of December 31, 2011, the fair value of the Company's investment in MFG was $2.5 million, which is $0.7 million, or 21.9%, below its

initial purchase price. The fair value of the investment declined below its initial purchase price in October 2010 when MFG publicly disclosed

that the Office of Thrift Supervision ("OTS") was requiring MetaBank to discontinue offering certain of its products, and obtain the written

approval of the OTS prior to, among other things, entering into any new third party agency agreements concerning any credit or deposit

product (including any prepaid access product) or materially amending any of its existing agreements.

The OTS, now the Office of the Comptroller of the Currency ("OCC") issued its final report to MetaBank in July 2011. The Company has

not determined that the decline in MFG's share price is other-than-temporary. The Company has recorded the related unrealized losses in

accumulated other comprehensive losses in the Consolidated Balance Sheets and Consolidated Statement of Changes in Stockholders' Equity

and will continue to assess the investment on a quarterly basis to determine whether any changes in facts or circumstances indicate that the

decline in value of this investment is other-than-temporary in nature. If the Company determines that the impairment is no longer temporary,

the Company will realize the current unrealized losses in its Consolidated Statement of Operations.

77

(in thousands

of dollars)

2012

$

2,272

2013

1,714

2014

1,714

2015

1,684

2016

1,641

Thereafter

2,587

$

11,612