NetSpend 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2011, 2010 and 2009

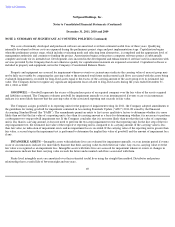

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

developed technology has a useful life of between three and seven years, license agreements have a useful life of twelve years, patents and

trademarks have a useful life of between twelve and twenty years. The Company's acquired tradenames have indefinite lives.

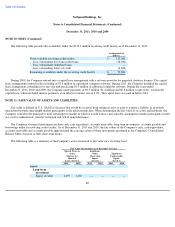

CARDHOLDERS' RESERVE —The Company is exposed to losses due to cardholder fraud, payment defaults and other forms of

cardholder activity as well as losses due to non-performance of third parties who receive cardholder funds for transmittal to the Issuing Banks.

The Company establishes a reserve for the losses it estimates will arise from processing customer transactions, debit card overdrafts,

chargebacks for unauthorized card use and merchant-related chargebacks due to non-delivery of goods or services. These reserves are

established based upon historical loss and recovery rates and cardholder activity for which specific losses can be identified. The cardholders'

reserve was approximately $3.9 million and $4.8 million as of December 31, 2011 and 2010, respectively. The Company regularly updates its

reserve estimate as new facts become known and events occur that may impact the settlement or recovery of losses.

Establishing the reserve for cardholder losses is an inherently uncertain process and the actual losses experienced by the Company may

vary from the current estimate.

LITIGATION —In the normal course of business, the Company is at times subject to pending and threatened legal actions and

proceedings. It is the Company's policy to routinely assess the likelihood of any adverse judgments or outcomes related to legal or regulatory

matters as well as ranges of probable losses. A determination of the amount of the reserves required, if any, for these contingencies is made

after analysis of each known issue and consultation with the Company's internal and external legal counsel. The Company records reserves

related to legal matters when it is determined that a loss is probable and the range of such loss can be reasonably estimated. Management

discloses facts regarding material matters assessed as reasonably possible and the associated potential exposure, if estimable. The Company

expenses legal costs as incurred.

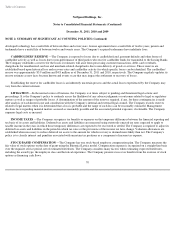

INCOME TAXES —The Company recognizes tax benefits or expenses on the temporary differences between the financial reporting and

tax basis of its assets and liabilities. Deferred tax assets and liabilities are measured using statutorily enacted tax rates expected to apply to

taxable income in the years in which those temporary differences are expected to be recovered or settled. The Company is required to adjust its

deferred tax assets and liabilities in the period in which tax rates or the provisions of the income tax laws change. Valuation allowances are

established when necessary to reduce deferred tax assets to the amount for which recovery is deemed more likely than not. The Company's

policy is to classify interest and penalties associated with uncertain tax positions as a component of income tax expense.

STOCK-BASED COMPENSATION —The Company has one stock-based employee compensation plan. The Company measures the

fair value of stock options on the date of grant using the Binomial Lattice model. Compensation expense is recognized on a straight-line basis

over the requisite service period, net of estimated forfeitures. The Company considers many factors when estimating expected forfeitures,

including the award type, the employee class and historical experience. The Company presents excess tax benefits from the exercise of stock

options as financing cash flows.

70