NetSpend 2011 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2011, 2010 and 2009

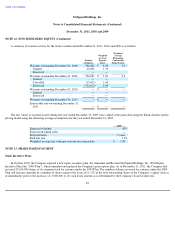

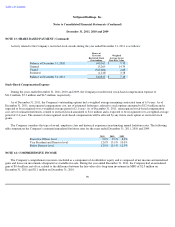

NOTE 12: STOCKHOLDERS' EQUITY

Common and Preferred Stock

Prior to its IPO in 2010, the Company's certificate of incorporation authorized the Company to issue 150,000,000 shares of class A

common stock, par value $0.001 per share, 15,000,000 shares of class B common stock, par value $0.001 per share and 10,000,000 shares of

undesignated preferred stock, par value $0.001 per share. Each share of class B common stock was convertible into one share of class A

common stock as set forth in the Company's certificate of incorporation.

On October 22, 2010, the Company completed an IPO of 18,536,043 shares of common stock at an offering price of $11.00 per share, of

which 2,272,727 shares were sold by the Company and 16,263,316 shares were sold by existing stockholders. The Company generated net

proceeds of approximately $20.9 million after deducting underwriting discounts and commissions and $2.4 million in total expenses incurred in

connection with the offering. Effective upon the completion of the IPO, certain selling stockholders exercised warrants to purchase 696,270

shares of class A common stock at a weighted-average exercise price of $1.69 per share. 102,065 of these shares were retained as payment of

the warrant exercise price and the remaining 594,205 shares were sold in the offering. In addition, certain employees exercised options to

purchase 890,594 shares of the Company's common stock, at a weighted average exercise price of $2.96 per share, and sold the 651,085 net

shares received thereby in connection with the closing of the offering.

Upon the completion of the IPO in 2010, the Company's certificate of incorporation was amended and restated to: reflect the

reclassification of the Company's class A common stock into common stock; increase the total number of authorized shares of common stock

from 150,000,000 to 225,000,000; and provide that all shares of the Company's class B common stock would automatically convert into shares

of common stock on a one-for-one basis upon the occurrence of certain events. Immediately following completion of the Company's IPO in

October 2010, Skylight Holdings I, LLC transferred all of the shares of the Company's class B common stock held by it to its members. As a

result of the transfer, Skylight Holdings I, LLC, JLL Partners Fund IV, L.P. ("JLL Fund IV"), JLL Partners Fund V, L.P. (collectively with JLL

Fund IV, the "JLL Funds") and their affiliates ceased to own or control 25% or more of the Company's voting securities and, pursuant to the

terms of the Company's amended and restated certificate of incorporation, all of the shares of the Company's class B common stock held by

them, which constituted all of the outstanding share of class B common stock, automatically converted into shares of common stock on a one-

for-one basis.

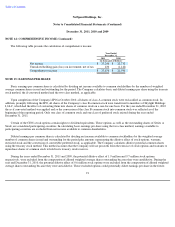

In 2011 the Company created a new series of preferred stock consisting of 1,500,000 shares, par value of $0.001 per share, pursuant to the

Company's articles of incorporation which authorizes the Company to issue up to 10,000,000 shares of $0.001 par value preferred stock. The

new series of preferred stock is designated as Series A Convertible Preferred Stock (the "Series A Stock").

Holders of the Series A Stock have no voting rights, other than as may be required by applicable law and no holder of Series A Stock has

a preemptive or preferential right to acquire or subscribe for any shares of securities of any class. The Series A Stock is not redeemable or

assessable or entitled to the benefits of any sinking fund. Shares of Series A Stock may be converted at the option of the holder, at any time,

into shares of the Company's common stock at the rate of ten shares of common stock for each share of Series A Stock; provided, however, that

no holder of shares of Series A Stock may convert any of their shares into common stock if (i) upon completing such conversion the holder,

82