NetSpend 2011 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Recent Developments

Issuing Bank Diversification

We are pursuing a bank diversification strategy pursuant to which we intend to distribute our card issuing activities across at least three

issuing banks, in addition to the banks that issue our payroll cards. We are focused on doing so in a manner that balances our diversification

strategy with the protection of existing cardholder and direct deposit relationships and other operational considerations. In furtherance of this

strategy we entered into an agreement with The Bancorp Bank ("Bancorp") in January 2011 pursuant to which Bancorp will serve as an Issuing

Bank for our new and existing card programs. Bancorp began issuing our cards in a pilot program in April 2011 and began issuing cards as part

of a commercial roll-out in October 2011. We are working diligently with Bancorp on a more extensive rollout. We are also continuing our

discussions with other prospective issuing banks.

In May 2011, we amended our agreement with Inter National Bank ("INB") to extend the date by which we agreed to transition the GPR

cards issued by INB to another bank from July 2011 to September 2011. We are in the process of transitioning the distributors of cards issued

by INB to another Issuing Bank and we are currently operating under the wind-down provisions of our agreement with INB.

U.S. Bank ("USB") and SunTrust Bank ("SunTrust") act as issuers of our payroll cards. We are actively seeking to transfer the USB

portfolio to another Issuing Bank and we currently expect to complete this transition in 2012. Our current contract with SunTrust automatically

renewed for one year at the end of 2011. We are actively seeking to sign agreements with additional banks to act as issuers of payroll cards. As

a result of these efforts, we recently signed agreements with Regions Bank and a large bank based in New England pursuant to which we will

act as the program manager for the payroll cards to be issued by them.

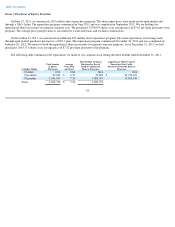

Share Repurchase Programs

On June 13, 2011, we announced a $25 million share repurchase program. The share repurchases were made on the open market and

through a 10b5-1 plan. The repurchase program commenced in June 2011 and was completed in September 2011. We are holding the

repurchased shares in treasury for general corporate uses. We purchased 3,276,093 shares at an average price of $7.63 per share pursuant to this

program. The average price paid per share is calculated on a trade date basis and excludes commissions.

On November 23, 2011, we announced an additional $25 million share repurchase program. The share repurchases were being made

through open market purchases pursuant to a 10b5-1 plan. The repurchase program commenced November 30, 2011 and has been completed.

We intend to hold the repurchased shares in treasury for general corporate purposes. As of December 31, 2011, we had purchased 1,043,751

shares at an average price of $7.32 per share pursuant to this program.

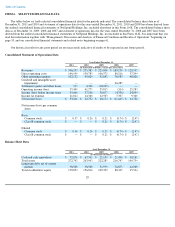

Key Business Metrics

As a leading provider of GPR cards and related alternative financial services to underbanked consumers, we evaluate a number of business

metrics to monitor our performance and manage our business. We believe the following metrics are the primary indicators of our performance.

Number of Active Cards —represents the total number of our GPR cards that have had a PIN or signature-based purchase transaction, a

load transaction at a retailer location or an ATM withdrawal within three months of the date of determination. We had approximately

2.1 million active cards as of December 31, 2011 and 2010, respectively, and 1.9 million active cards as of December 31, 2009.

34