NetSpend 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2011, 2010 and 2009

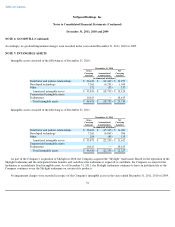

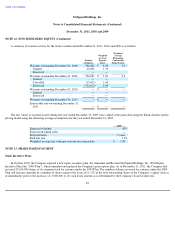

NOTE 5: PROPERTY AND EQUIPMENT

Property and equipment consisted of the following as of December 31, 2011 and 2010:

During 2009, the Company entered into a capital lease arrangement with a software provider for perpetual database licenses. The capital

lease arrangement resulted in the recording of $3.4 million in capitalized computer software. During 2011, the Company modified the capital

lease arrangement, extending it for one year and purchasing $1.9 million of additional computer software. The computer software is included in

property and equipment on the Company's Consolidated Balance Sheets.

Depreciation expense, which includes amortization of the capital lease described above, for the years ended December 31, 2011, 2010 and

2009 was approximately $11.5 million, $9.5 million and $6.8 million, respectively.

During the years ended December 31, 2011, 2010 and 2009, the Company capitalized interest costs of less than $0.1 million, $0.1 million

and $0.2 million, respectively, related to internally developed software.

NOTE 6: GOODWILL

The Company's goodwill balance is the result of acquiring: all of the capital stock of NetSpend Corporation through a recapitalization

transaction in 2004; the acquisition of Skylight Financial, Inc. ("Skylight") in 2008, a company that is focused on the market for direct deposit

payroll accounts; and Procesa International, LLC ("Procesa"), a service provider for direct, cross-border and cell phone top-up payment

services for Latin America in 2008.

Goodwill is tested for impairment annually or if an event occurs or conditions change that would more likely than not reduce the fair value

of the reporting unit below its carrying value. In 2009 and 2010, the Company performed the first step of the two-step impairment test and

determined that the fair value of its goodwill exceeded the carrying value. In 2011, the Company adopted the amendments included in the

FASB's ASU 2011-08 under which it first assessed qualitative factors to determine whether the existence of events or circumstances would

lead to a determination that it is more likely than not that the fair value of a reporting unit is less than its carrying amount. Based on its analysis,

the Company determined it was not more likely than not that that the fair values of its reporting units were less than their respective carrying

amounts, and no further impairment testing was performed.

75

December 31,

2011 2010

(in thousands of dollars)

Computer and office equipment

$

17,563

$

13,983

Computer software

31,812

26,568

Furniture and fixtures

1,431

1,368

Leasehold improvements

1,639

1,625

Construction in progress

4,013

2,579

56,458

46,123

Less: Accumulated depreciation

(35,827

)

(25,116

)

$

20,631

$

21,007