NetSpend 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

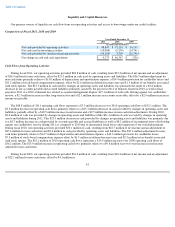

Table of Contents

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are exposed to certain market risks as part of our ongoing business operations. These risks are primarily associated with fluctuating

interest rates for borrowings under our revolving credit facility. Borrowings under this facility bear interest based on current market rates. We

have not historically used derivative financial instruments to manage this market risk. As of December 31, 2011, we had borrowed

$58.5 million under our revolving credit facility. This facility has a maturity date of September 2015. Interest on this debt accrued at a weighted

average rate of 2.8% during fiscal 2011. A 1.0% increase or decrease in interest rates would have had a $0.6 million impact on our operating

results and cash flows for fiscal 2011.

The table below presents principal amounts and related weighted average interest rates as of December 31, 2011 for our revolving credit

facility:

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The information required by this item is set forth in the consolidated financial statements appearing on pages 61 through 105 hereof.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

There were no changes in or disagreements with our accountants on accounting and financial disclosure matters.

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our Chief Executive Officer and our Chief Financial Officer, evaluated the effectiveness of our

disclosure controls and procedures as of December 31, 2011. The term "disclosure controls and procedures" is defined in Rules 13a-15(e) and

15d-15(e) under the Exchange Act to mean controls and other procedures of a company that are designed to ensure that information required to

be disclosed by it in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time

periods specified in the SEC's rules and forms. Based on the evaluation of our disclosure controls and procedures as of December 31, 2011, our

Chief Executive Officer and Chief Financial Officer concluded that, as of such date, our disclosure controls and procedures were effective at

the reasonable assurance level.

Management's Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Management assessed

the effectiveness of our internal control over financial reporting as of December 31, 2011. Based on management's assessment, management

has concluded that our internal control over financial reporting was effective as of December 31, 2011 using the criteria set forth by the

Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control—Integrated Framework.

Our internal control over financial reporting is designed to provide reasonable, but not absolute, assurance regarding the reliability of

financial reporting and the preparation of financial statements in accordance with U.S. generally accepted accounting principles. There are

inherent limitations to the

51

(in thousands of dollars)

Revolving credit facility

$

58,500

Weighted average interest rate

2.8

%