NetSpend 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2011, 2010 and 2009

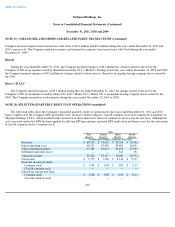

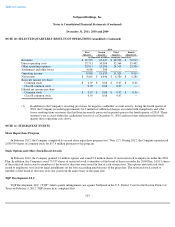

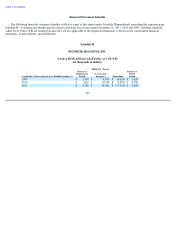

NOTE 20: SELECTED QUARTERLY RESULTS OF OPERATIONS (unaudited) (Continued)

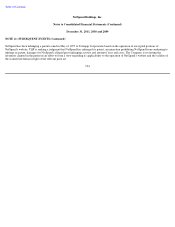

NOTE 21: SUBSEQUENT EVENTS

Share Repurchase Program

In February 2012, the Company completed its second share repurchase program (see "Note 12"). During 2012, the Company repurchased

2,050,959 shares of common stock for $17.4 million pursuant to this program.

Stock Options and Other Stock-Based Awards

In February 2012, the Company granted 1.3 million options and issued 0.6 million shares of restricted stock to employees under the 2004

Plan. In addition, the Company issued 75,937 shares of restricted stock to members of the board of directors under the 2004 Plan. 34,915 shares

of the restricted stock issued to members of the board of directors were issued in lieu of cash retainer fees. The options and restricted stock

issued to employees vests in four equal installments on the four succeeding anniversaries of the grant date. The restricted stock issued to

members of the board of directors vests one year from the anniversary of the grant date.

TQP Development, LLC

TQP Development, LLC ("TQP") filed a patent infringement case against NetSpend in the U.S. District Court for the Eastern District of

Texas on February 9, 2012. TQP asserts in its complaint that

103

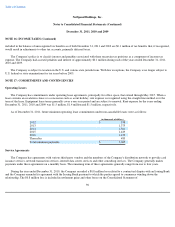

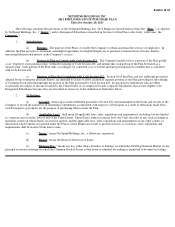

2010

First

Quarter Second

Quarter Third

Quarter Fourth

Quarter(1)

(in thousands of dollars, except per share data)

Revenues

$

69,520

67,447

$

68,208

$

70,212

Direct operating costs

32,713

30,304

32,364

35,402

Other operating expenses

23,911

25,204

24,518

25,396

Settlements and other losses

4,000

300

—

—

Operating income

8,896

11,639

11,326

9,414

Net income

$

4,618

$

6,446

$

6,380

$

5,288

Basic net income per share

Common stock

$

0.05

$

0.08

$

0.07

$

0.06

Class B common stock

0.05

0.08

0.07

—

Diluted net income per share

Common stock

$

0.05

$

0.08

$

0.07

$

0.06

Class B common stock

0.05

0.08

0.07

—

(1) In addition to the Company's recurring provisions for negative cardholder account activity, during the fourth quarter of

2010, the Company recorded approximately $1.3 million of additional charges associated with chargebacks and other

losses resulting from recoveries that had been incorrectly processed in periods prior to the fourth quarter of 2010. These

amounts were accrued within the cardholders' reserve as of December 31, 2010 and have been reflected in the fourth

quarter direct operating costs above.