NetSpend 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2011, 2010 and 2009

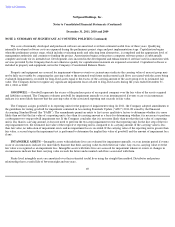

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

The costs of internally developed and purchased software are amortized over their estimated useful lives of three years. Qualifying

internally developed software costs are expensed during the preliminary project stage and post implementation stage. Capitalization begins

when the preliminary project stage, which includes evaluating needs and selecting from alternatives, is completed and the appropriate level of

management authorizes and commits to funding the project. Amortization begins at the point a computer software project is substantially

complete and ready for its intended use. Development costs incurred in the development and enhancement of software used in connection with

services provided by the Company that do not otherwise qualify for capitalization treatment are expensed as incurred. Capitalized software is

included in property and equipment, net in the Company's Consolidated Balance Sheets.

Property and equipment are assessed for impairment whenever events or circumstances indicate the carrying value of an asset group may

not be fully recoverable by comparing the carrying value to the estimated total future undiscounted cash flows associated with the assets being

evaluated. Impairment is recorded for long-lived assets equal to the excess of the carrying amount of the asset group over its estimated fair

value. The Company did not recognize any significant impairment losses related to long-lived assets during the years ended December 31,

2011, 2010 or 2009.

GOODWILL —Goodwill represents the excess of the purchase price of an acquired company over the fair value of the assets acquired

and liabilities assumed. The Company evaluates goodwill for impairment annually or at an interim period if events occur or circumstances

indicate it is more likely than not that the carrying value of the associated reporting unit exceeds its fair value.

The Company assigns goodwill to its reporting units for the purpose of impairment testing. In 2011, the Company adopted amendments to

the guidelines for testing goodwill for impairment contained in Accounting Standards Update ("ASU") 2011-08 issued by the Financial

Accounting Standard Board (the "FASB"). The amendments permit an entity to first assess qualitative factors to determine whether it is more

likely than not that the fair value of a reporting unit is less than its carrying amount as a basis for determining whether it is necessary to perform

a subsequent two-step goodwill impairment test. If the Company concludes that it is not more likely than not that the fair value of a reporting

unit is less than its carrying amount, it does not need to perform the two-step impairment test for that reporting unit. In the first step of the two

step impairment test, the estimated fair value of the respective reporting unit is compared to its carrying amount. If the carrying value is less

than fair value, no indication of impairment exists and no impairment loss is recorded. If the carrying value of the reporting unit is greater than

fair value, a second step in the impairment test is performed to determine the implied fair value of goodwill and the amount of impairment loss,

if any.

INTANGIBLE ASSETS —Intangible assets with indefinite lives are evaluated for impairment annually, or at an interim period if events

occur or circumstances indicate it is more likely than not that their carrying value exceeds their fair value. Any excess carrying value over the

fair value is recognized as an impairment loss. Intangible assets with finite lives are assessed for impairment whenever events or changes in

circumstances indicate that their carrying value exceeds the future undiscounted cash flows associated with them.

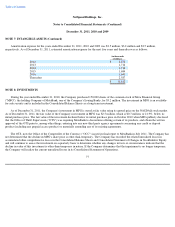

Finite lived intangible assets are amortized over their estimated useful lives using the straight-line method. Distributor and partner

relationships have a useful life of between eight and ten years,

69