NetSpend 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2011, 2010 and 2009

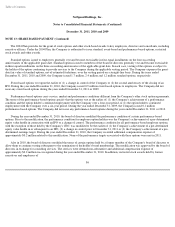

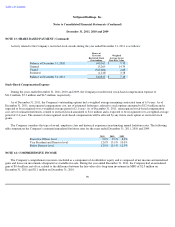

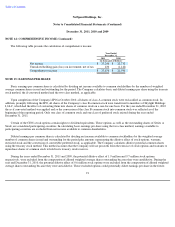

NOTE 12: STOCKHOLDERS' EQUITY (Continued)

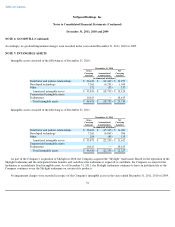

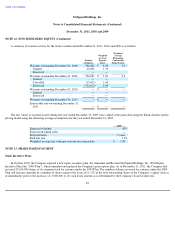

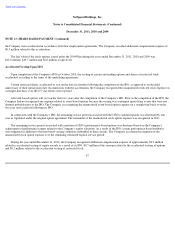

A summary of warrant activity for the twelve months ended December 31, 2011, 2010 and 2009 is as follows:

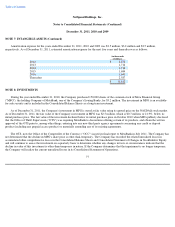

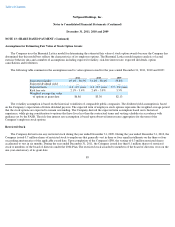

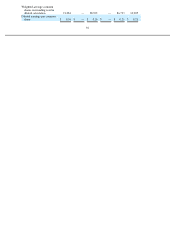

The fair values of warrants issued during the year ended December 31, 2009 were valued at the grant date using the Black-Scholes option

pricing model using the following average assumptions for the year ended December 31, 2009.

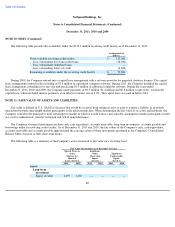

NOTE 13: SHARE BASED PAYMENT

Stock Incentive Plans

In October 2010, the Company adopted a new equity incentive plan, the Amended and Restated NetSpend Holdings, Inc. 2004 Equity

Incentive Plan (the "2004 Plan"), which amended and replaced the Company's prior option plan. As of December 31, 2011, the Company had

reserved 25,104,980 shares of its common stock for issuance under the 2004 Plan. The number of shares reserved for issuance under the 2004

Plan will increase annually by a number of shares equal to the lesser of (1) 3% of the total outstanding shares of the Company's capital stock as

of immediately prior to the increase, (2) 3,000,000 or (3) such lesser amount as is determined by the Company's board of directors.

85

Number

of Shares

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Term (Years)

Warrants outstanding December 31, 2008

706,683

$

1.69

5.2

Granted

20,000

1.50

Exercised

—

—

Warrants outstanding December 31, 2009

726,683

$

1.69

4.3

Granted

—

—

Cancelled

(15,031

)

1.69

Exercised

(711,652

)

1.69

Warrants outstanding December 31, 2010

—

$

—

—

Granted

—

—

Exercised

—

—

Warrants outstanding December 31, 2011

—

$

—

—

Exercisable and outstanding December 31,

2011

—

$

—

—

2009

Expected volatility

60

%

Expected dividend yield

—

Expected term

5 years

Risk free rate

1.7

%

Weighted average fair value per warrant at issuance date

$

1.80