NetSpend 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2011, 2010 and 2009

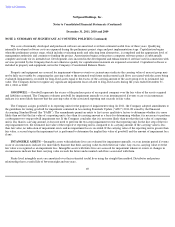

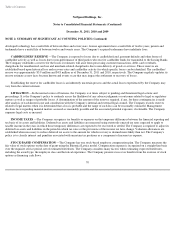

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

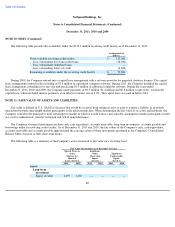

EARNINGS PER SHARE —Basic earnings (loss) per common share excludes dilution for potential common stock issuances and is

calculated by dividing net income (loss) available to common stockholders by the weighted average number of common shares issued and

outstanding during the period. Diluted earnings per common share is calculated by dividing net income by the weighted average number of

common shares issued and outstanding during the period plus amounts representing the dilutive effect of stock options, warrants and restricted

stock and convertible preferred stock, as applicable. The Company calculates basic and diluted earnings (loss) per common share using the

treasury stock method, the as-if-converted method and the two-class method, as applicable.

REVENUE RECOGNITION —The Company's operating revenue principally consists of a portion of the service fees and interchange

revenues received by the Issuing Banks in connection with the programs managed by the Company. Revenue is recognized when there is

persuasive evidence of an arrangement, the relevant services have been rendered, the price is fixed or determinable and collectability is

reasonably assured.

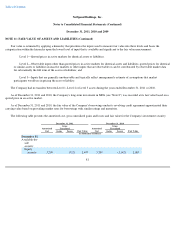

Cardholders are charged fees in connection with the products and services provided, as follows:

• Transactions—Cardholders are typically charged a fee for each PIN and signature-based purchase transaction made using

their GPR cards, unless the cardholder is on a monthly or annual service plan, in which case the cardholder is instead charged a

monthly or annual subscription fee, as applicable. Cardholders are also charged fees for ATM withdrawals and other

transactions conducted at ATMs.

• Customer Service and Maintenance—Cardholders are typically charged fees for balance inquiries made through the Company's

call centers. Cardholders are also charged a monthly maintenance fee after a specified period of inactivity.

• Additional Products and Services—Cardholders are charged fees associated with additional products and services offered in

connection with certain GPR cards, including the use of overdraft features, a variety of bill payment options, custom card

designs and card-to-card transfers of funds initiated through the Company's call centers.

• Other—Cardholders are charged fees in connection with the acquisition and reloading of the Company's GPR cards at retailers

and the Company receives a portion of these amounts in some cases.

Revenue resulting from the service fees charged to cardholders described above is recognized when the fees are charged because the

earnings process is substantially complete, except for revenue resulting from the initial activation of the Company's cards and annual

subscription fees. Revenue resulting from the initial activation of cards is recognized ratably, net of commissions paid to distributors, over the

average account life, which is approximately one year for GPR cards (three months for the gift cards the Company marketed prior to August

2010). Revenue resulting from annual subscription fees is recognized ratably over the annual period to which the fees relate.

Revenues also include fees charged in connection with program management and processing services the Company provides for private-

label programs, as well as fees charged to MetaBank based on interest earned on cardholder funds. Under the Company's current arrangement

with MetaBank, the Company would only be entitled to receive interest on cardholder funds if market interest rates

71