NetSpend 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2011, 2010 and 2009

NOTE 12: STOCKHOLDERS' EQUITY (Continued)

together with its affiliates, would own or control shares of common stock representing 24.9% or more of the outstanding voting securities of

the Company or (ii) such conversion would require prior approval or notice under any state law then applicable to the Company or its

subsidiaries.

In the event any dividends are declared or paid on the Company's common stock, holders of Series A Stock would be entitled to receive

dividends in an amount equal to the amount of the dividends that the holder would have received had their Series A Stock been converted into

common stock as of the date immediately prior to the record date for such dividend.

In the event of liquidation, dissolution or winding up of the Company, any assets and funds legally available for distribution would be

distributed ratably among the holders of the common stock and Series A Stock in proportion to the number of shares of such stock owned by

each such holder. In the case of holders of Series A Stock, any such distribution would be based on the number of shares of common stock that

they would have received had their Series A Stock been converted into common stock immediately prior to such distribution.

During 2011, the JLL Funds exchanged 7,000,000 shares of common stock held by them for an aggregate of 700,000 shares of Series A

Stock in a transaction exempt from the registrations requirements of the Securities Act of 1933, as amended, pursuant to Section 3(a)(9)

thereof. The JLL Funds beneficially owned more than five percent of the Company's outstanding common stock as of December 31, 2011. No

commissions or other remuneration was or will be paid or given, directly or indirectly, to the JLL Funds or any other person in connection with

the exchange. The shares of Series A Stock issued to the JLL Funds will be automatically re-

converted into shares of common stock (at the rate

of ten shares of common stock for each share of Series A Stock) if they are sold or otherwise transferred to a person who is not affiliated with

the JLL Funds.

Treasury Stock Transactions

Treasury stock is accounted for under the cost method and is included as a component of stockholders' equity.

In 2009, the Company reached agreements with the defendants named in the MPower litigation that settled all disputes and claims

between the Company and the defendants (see "Note 17"). In connection with this settlement, the Company assumed 570,000 shares of

outstanding common stock (formerly "class A common stock") held by the defendants. This settlement transaction resulted in the Company's

non-cash acquisition of 400,000 shares of treasury stock, which is recorded as a litigation settlement gain of $1.2 million on the Company's

Consolidated Statement of Operations, and a $0.2 million cash purchase of 170,000 shares of treasury stock.

In 2010, the Company repurchased 1,500,000 shares of its common stock for $5.7 million.

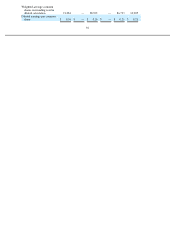

In 2011, the Company's board of directors approved two $25 million share repurchase programs, the first of which was completed in

September 2011. The Company repurchased 3,276,093 shares of common stock for $25.1 million pursuant to the first share repurchase

program. The Company repurchased 1,043,751 shares of common stock for $7.7 million pursuant to the second share repurchase program

during 2011.

83