NetSpend 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2011, 2010 and 2009

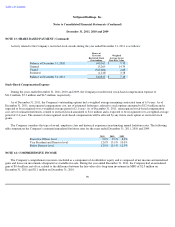

NOTE 17: COMMITMENTS AND CONTINGENCIES (Continued)

(TCCWNA) and claiming unjust enrichment in connection with the Defendants' alleged marketing, advertising, sale and post-sale handling of

NetSpend's gift card product in the State of New Jersey. In March 2011, the court heard oral arguments on Defendants' motion to dismiss

Baker's amended complaint. On January 19, 2012, the court granted Defendants' motion in part and dismissed all claims except for the cause of

action based on the alleged violation of the CFA. The Company filed its answer and affirmative defenses on February 3, 2012 and it plans to

vigorously contest Baker's claims.

MPower Litigation

In 2008, the Company filed a lawsuit against MPower Ventures, LP, MPower Labs, Inc., Mango Financial, Inc., MPower Ventures

Management, LLC, Rogelio Sosa, Bertrand Sosa, Richard Child and John Mitchell and subsequently amended the suit to add Futeh Kao and

Mattrix Group, L.L.C (collectively, the "defendants"). In this lawsuit, the Company alleged breach of fiduciary duties, breach of contractual

and common-law duties of confidentiality, breach of contractual non-solicitation clauses, misappropriation of the Company's trade secrets and

other confidential and proprietary information belonging to the Company, breach of noncompetition agreements and engagement in a civil

conspiracy. Defendant Mitchell asserted counterclaims against the Company alleging breach of contract relating to consulting services and

payment of certain dividends, as well as for defamation. Mitchell sought actual and consequential damages and attorneys' fees.

In 2009, the Company reached agreements with the defendants settling all disputes and claims between the parties. In connection with the

settlement, the Company acquired 570,000 shares of its outstanding common stock held by certain of the defendants. The settlement

transactions resulted in the Company's non-cash acquisition of 400,000 shares of common stock, which is recorded as a litigation settlement

gain of $1.2 million in the Company's Consolidated Statement of Operations and a $0.6 million cash payment to Richard Child which included

the repurchase of 170,000 shares of common stock for $0.2 million.

Katz Settlement

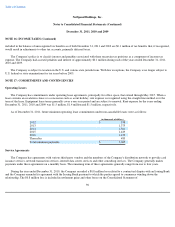

In 2008, the Company received a letter from Ronald A. Katz Technology Licensing, L.P. ("RAKTL"), which contained an offer for the

Company to acquire a license under the RAKTL portfolio of patents. In July 2010, the Company and RAKTL agreed to settle this matter. In

accordance with the agreement, the Company paid RAKTL a total of $3.5 million in exchange for the Company's release from potential

infringement liability related to the Company's possible use of RAKTL patents. As part of the agreement, the Company also acquired a non-

exclusive license related to certain pending RAKTL patents. The $3.5 million loss was recorded in settlement gains and other losses on the

Consolidated Statement of Operations for the year ended December 31, 2010.

Recoveries

In 2009, the Company, in conjunction with two of its Issuing Banks, identified approximately $10.6 million of excess funds related to

several years of chargebacks and fee-related recoveries from the Networks, much of which the Company had previously written off in its loss

reserves. The Company had previously recorded receivables of approximately $1.6 million associated with these items. As a result, the

Company recorded a $9.0 million settlement gain in its Consolidated Statement of

99