NetSpend 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2011, 2010 and 2009

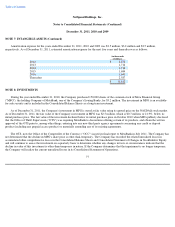

NOTE 13: SHARE BASED PAYMENT (Continued)

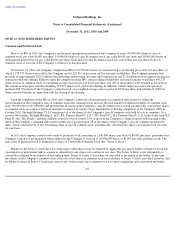

the Company were accelerated in accordance with their employment agreements. The Company recorded additional compensation expense of

$0.5 million related to this acceleration.

The fair value of the stock options issued under the 2004 Plan during the years ended December 31, 2011, 2010 and 2009 was

$12.0 million, $10.7 million and $4.6 million, respectively.

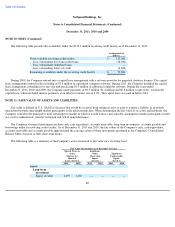

Accelerated Vesting Upon IPO

Upon completion of the Company's IPO in October 2010, the vesting of certain outstanding options and shares of restricted stock

accelerated according to the terms of the underlying agreements.

Certain restricted shares accelerated to vest on the date six months following the completion of the IPO, as opposed to on the third

anniversary of their initial grant date. In connection with the acceleration, the Company recognized the unamortized restricted stock expense on

a straight-line basis over the 0.5 year future service period.

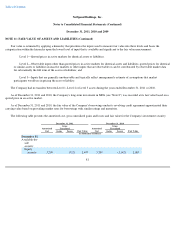

All event-based options will vest on the date two years after the completion of the Company's IPO. Prior to the completion of the IPO, the

Company had not recognized any expense related to event-based options because the vesting was contingent upon future events that were not

deemed probable prior to the IPO. The Company is recognizing the unamortized event-based option expense on a straight-line basis over the

two year service period following its IPO.

In connection with the Company's IPO, the remaining service period associated with the CEO's standard options was shortened by one

year as stipulated under the original option agreement. The remainder of the unamortized stock option expense was recognized in 2011.

The remaining service period associated with a portion of CEO's performance-based options was shortened based on the Company's

achievement of performance targets related to the Company's equity valuation. As a result of the IPO, certain performance based attributes

were triggered in addition to the time based vesting conditions embedded in these awards. The Company accelerated recognition of the

unamortized stock option expense over the remaining estimated explicit service period.

During the year ended December 31, 2010, the Company recognized additional compensation expense of approximately $0.9 million

related to accelerated vesting of equity awards as a result of its IPO. $0.7 million of this amount related to the accelerated vesting of options

and $0.2 million related to the accelerated vesting of restricted stock.

87