NetSpend 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2011, 2010 and 2009

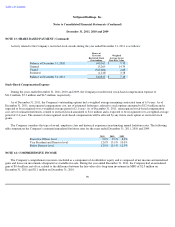

NOTE 12: STOCKHOLDERS' EQUITY (Continued)

Dividend Equivalents

Certain of the stock options issued to the Company's Chief Executive Officer (the "CEO") prior to the Company's IPO in October 2010

contain rights to dividend equivalents. The dividend equivalents relate to dividends paid by the Company in 2008 and were paid when the

underlying options vested. During the years ended December 31, 2011, 2010 and 2009, the Company paid $0.4 million, $0.2 million and $0.2

million, respectively, in cash dividend equivalents.

Dividends

In 2008, the Company declared a $30.0 million dividend. The Company paid $25.0 million of the $30.0 million dividend in 2008 and paid

the remaining $5.0 million in March 2009. The Company did not declare or pay any dividends during the years ended December 31, 2011 or

2010.

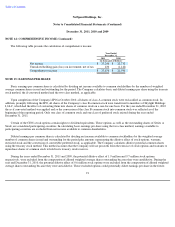

Warrants

In 2009, the Company issued warrants to purchase 20,000 shares of common stock to one of its distribution partners at an exercise price of

$1.50 per share. These warrants were exercised in 2010. No warrants were exercised in 2009.

In 2010, the Company did not issue any warrants to purchase shares of common stock. Prior to the Company's IPO in 2010, 15,382

warrants were exercised, resulting in additional paid-in capital of less than $0.1 million. In conjunction with the Company's IPO in October

2010, 696,270 warrants were exercised, of which 102,065 were retained by the Company as consideration for the exercise price, resulting in net

shares issued in connection with warrant exercises of 594,205. The exercise of warrants during the year ended December 31, 2010 resulted in

additional paid-in capital to the Company of less than $0.1 million.

No warrants were issued or exercised in 2011.

84