NetSpend 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2011, 2010 and 2009

NOTE 17: COMMITMENTS AND CONTINGENCIES (Continued)

Operations for the year ended December 31, 2010. As of December 31, 2011, $0.4 million was remaining in accrued expenses on the

Consolidated Balance Sheets.

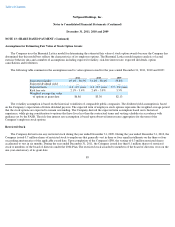

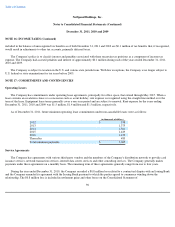

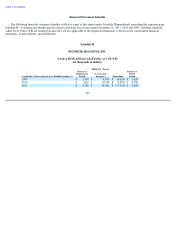

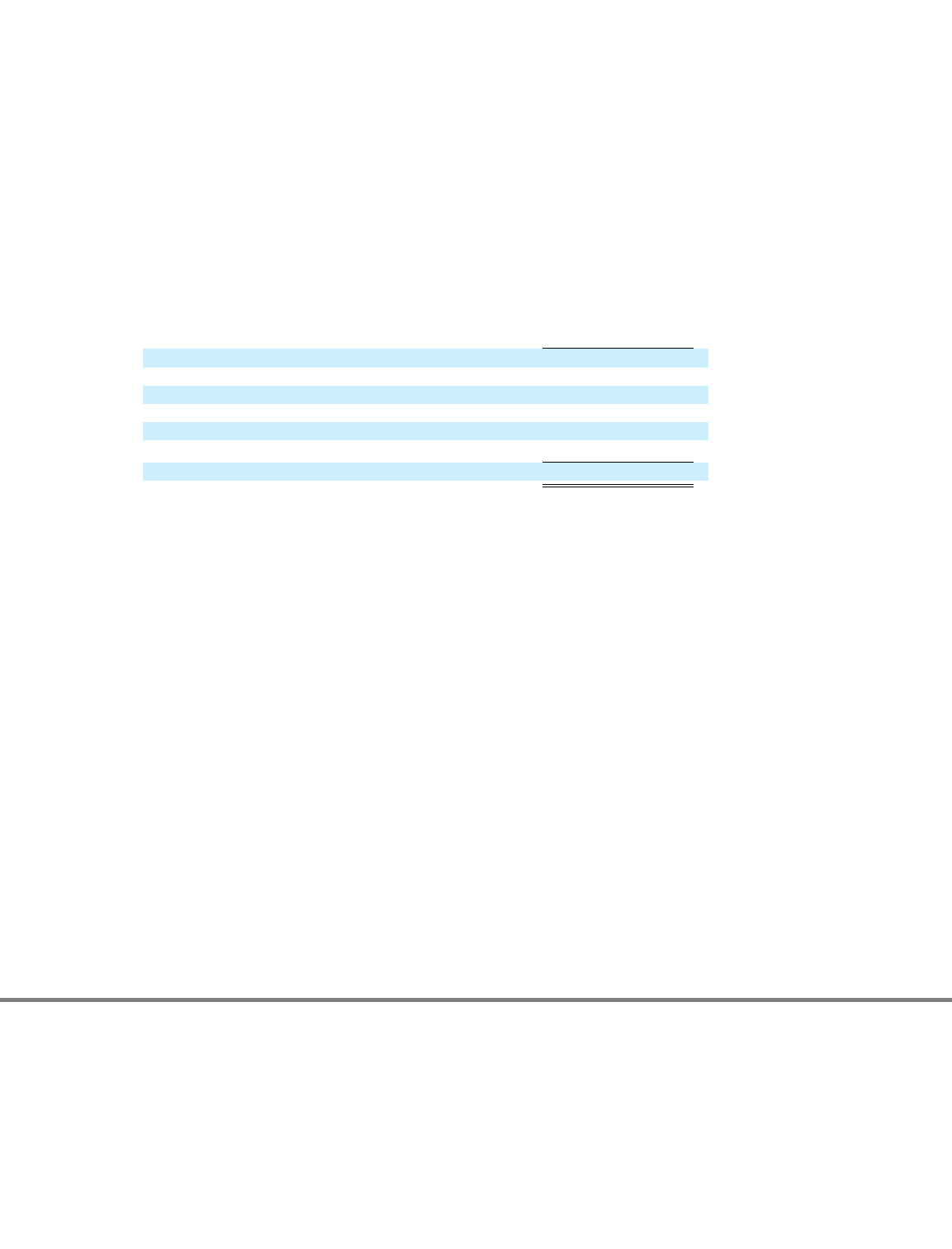

As of December 31, 2011, future minimum commitments under non-cancelable service agreements are as follows:

Guarantees

A significant portion of the Company's business is conducted through retail distributors that provide load and reload services to

cardholders at their locations. Members of the Company's distribution and reload network collect cardholders' funds and remit them by

electronic transfer to the Issuing Banks for deposit in the cardholder accounts. The Company's Issuing Banks typically receive cardholders'

funds no earlier than three business days after they are collected by the retailer. If any retailer fails to remit cardholders' funds to the Company's

Issuing Banks, the Company typically reimburses the Issuing Banks for the shortfall created thereby. The Company manages the risk

associated with this process through a formalized set of credit standards, volume limits and deposit requirements for certain retailers and by

typically maintaining the right to offset any settlement shortfall against the commissions payable to the relevant retailer. To date, the Company

has not experienced any significant losses associated with settlement failures and the Company had not recorded a settlement guarantee liability

as of December 31, 2011 or December 31, 2010. As of December 31, 2011 and December 31, 2010, the Company's estimated gross settlement

exposure was $17.1 million and $13.9 million, respectively.

Cardholders can in some circumstances incur charges in excess of the funds available in their accounts and are liable for the resulting

overdrawn account balance. Although the Company generally declines authorization attempts for amounts that exceed the available balance in

a cardholder's account, the application of the Networks' rules and regulations, the timing of the settlement of transactions and the assessment of

subscription, maintenance or other fees can, among other things, result in overdrawn card accounts. The Company also provides, as a courtesy

and in its discretion, certain cardholders with a "cushion" that allows them to overdraw their card accounts by up to $10. In addition, eligible

cardholders may enroll in the Issuing Banks' overdraft protection programs and fund transactions that exceed the available balance in their

accounts. The Company generally provides the funds used as part of this overdraft program (MetaBank will advance the first $1.0 million on

behalf of its cardholders) and is responsible to the Issuing Banks for any losses associated with any overdrawn account balances. As of

December 31, 2011 and 2010, cardholders' overdrawn account balances totaled $9.0 million and

97

(in thousands of dollars)

2012

$

15,013

2013

10,992

2014

6,612

2015

2,819

2016

—

Thereafter

—

Total minimum payments

$

35,436