NetSpend 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

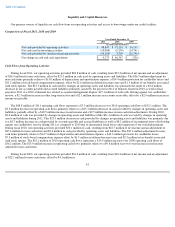

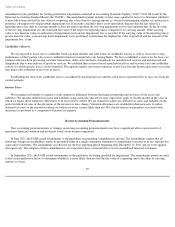

Our contractual commitments and contingencies will have an impact on our future liquidity. The following table summarizes our

contractual obligations that represent material expected or contractually committed future obligations as of December 31, 2011:

Critical Accounting Policies and Estimates

We prepare our consolidated financial statements in accordance with accounting principles generally accepted in the United States of

America, or U.S. GAAP. In many cases, the accounting treatment of a particular transaction is specifically dictated by U.S. GAAP and does not

require management's judgment in its application. In other cases management's judgment is required in selecting among available alternative

accounting standards that allow different accounting treatment for similar transactions. The preparation of consolidated financial statements

also requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, costs and expenses and

related disclosures. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the

circumstances. Accordingly, actual results could differ significantly from our estimates. To the extent that there are differences between our

estimates and actual results, our future financial statement presentation, financial condition, results of operations and cash flows will be

affected. We believe that the accounting policies discussed below are critical to understanding our historical and future performance because

these policies relate to the more significant areas involving management's judgments and estimates.

Revenue Recognition

Our operating revenues principally consist of a portion of the service fees and interchange revenues received by our Issuing Banks in

connection with the programs we manage. Revenue is recognized when there is persuasive evidence of an arrangement, the relevant services

have been rendered, the price is fixed or determinable and collectability is reasonably assured.

Our cardholders are charged fees in connection with our products and services as follows:

• Transactions—Cardholders are typically charged a fee for each PIN and signature-based purchase transaction made using

their GPR cards, unless the cardholder is on a monthly or

47

Payments Due by Period

As Of December 31, 2011

Total Less than

1 Year 1 - 3 Years 3 - 5 Years More than

5 Years

(in thousands of dollars)

Long

-

term debt obligations(1)

$

67,803

$

1,801

$

5,142

$

60,860

$

—

Operating lease obligations(2)

7,065

938

2,736

2,908

483

Other long

-

term obligations(3)

35,436

15,013

17,604

2,819

—

Total

$

110,304

$

17,752

$

25,482

$

66,587

$

483

(1) Long-term debt obligations consisted of outstanding principal and expected interest payments under our credit facility as

of December 31, 2011. These future expected payments include $58.5 million of principal that is expected to be repaid

upon the maturity of this facility in September 2015 and $9.3 million in future interest payments applicable to the

currently outstanding borrowings at an expected interest rate of 4.3% per year through September 2015.

(2) Operating lease obligations primarily include future payments related to the lease for our offices in Austin, Texas. This

lease expires in 2017.

(3) Other long-term obligations consist of required minimum future payments under contracts with our distributors and other

service providers.