NetSpend 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2011, 2010 and 2009

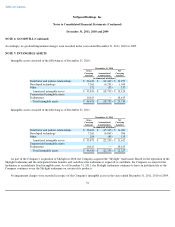

NOTE 13: SHARE BASED PAYMENT (Continued)

The 2004 Plan provides for the grant of stock options and other stock-

based awards to key employees, directors and consultants, including

executive officers. Under the 2004 Plan, the Company is authorized to issue standard, event-based and performance-based options, restricted

stock awards and other awards.

Standard options issued to employees generally vest and become exercisable in four equal installments on the four succeeding

anniversaries of the applicable grant date. Standard options issued to members of the board of directors generally vest and become exercisable

in three equal installments on the three succeeding anniversaries of the applicable grant date. In each case, vesting of the options is subject to

the holder of the option continuing to provide services to the Company during the applicable vesting period. The Company expenses the grant-

date fair value of standard options, net of estimated forfeitures, over the vesting period on a straight-line basis. During the years ended

December 31, 2011, 2010 and 2009, the Company issued 1.7 million, 2.4 million and 1.2 million standard options, respectively.

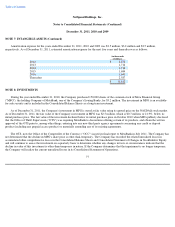

Event-based options vest upon the earlier of (1) a change in control of the Company or (2) the second anniversary of the closing of an

IPO. During the year ended December 31, 2010, the Company issued 0.9 million event-based options to employees. The Company did not

issue any event-based options during the years ended December 31, 2011 or 2009.

Performance-

based options carry service, market and performance conditions different from the Company's other stock option agreements.

The terms of the performance-based options specify that the options vest at the earlier of: (1) the Company's achievement of a performance

condition and the option holder's continued employment with the Company over a four-year period, or (2) the option holder's continued

employment with the Company over a six-year period. During the year ended December 31, 2009, the Company issued 0.1 million

performance-based options. The Company did not issue any performance-based options during the years ended December 31, 2011 or 2010.

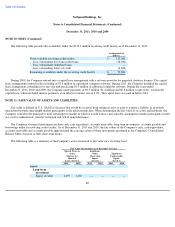

During the year ended December 31, 2010, the board of directors modified the performance condition of certain performance-based

options. Prior to the modification, the performance condition for employee option holders was the Company's achievement of a pre-determined

equity value hurdle in connection with an IPO or a change of control. The performance condition for all performance-based employee options,

with the exception of those held by the Company's CEO, was modified to be the earlier of (1) the Company's achievement of a pre-determined

equity value hurdle in or subsequent to an IPO, (2) a change in control prior to December 31, 2011 or (3) the Company's achievement of a pre-

determined earnings target. During the year ended December 31, 2010, the Company recorded additional compensation expense of

approximately $0.2 million related to this modification. None of the performance targets associated with these options were met in 2011.

Also in 2010, the board of directors modified the terms of certain options held by a former member of the Company's board of directors to

allow them to continue vesting subsequent to the termination of the holder's board membership. The modification was approved by the board of

directors in exchange for consulting services. The services were deemed non-substantive and additional compensation expense of

approximately $0.2 million was recognized during the year ended December 31, 2010. In addition, restricted stock awards held by former

executives and employees of

86