NetSpend 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2011, 2010 and 2009

NOTE 16: INCOME TAXES (Continued)

The exercise of certain Company stock options results in compensation that is includable in the taxable income of the exercising option

holder and deductible by the Company for federal and state income tax purposes. Such compensation results from increases in the fair market

value of the Company's common stock subsequent to the date of grant of the exercised stock options. Any option related excess tax benefits

(tax deduction greater than cumulative book deduction) are recorded as an increase to additional paid-in capital, while option related tax

deficiencies (cumulative book deduction greater than tax deduction) are recorded as a decrease to additional paid-in capital to the extent of the

Company's additional paid-in capital option pool, then to its income tax provision. During the year ended December 31, 2011, option-related

tax deductions resulted in increases to additional paid-in capital of $1.5 million. During the year ended December 31, 2010, option-related tax

deductions resulted in increases to additional paid-in capital of $2.5 million. During the year ended December 31, 2009, the shortfall related to

the Company's stock-options resulted in a decrease to additional paid-in-capital of $0.2 million.

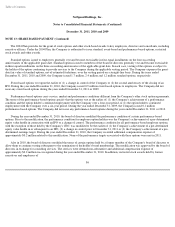

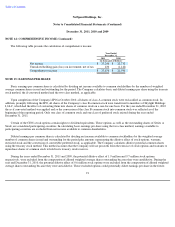

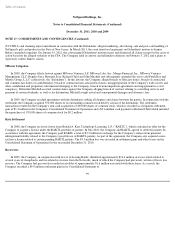

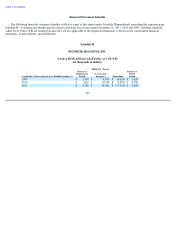

The Company's provision for income taxes differs from the expected tax expense (benefit) amount computed by applying the statutory

federal income tax rate of 35% to income before income taxes for the years ended December 31, 2011, 2010 and 2009 primarily as a result of

the following:

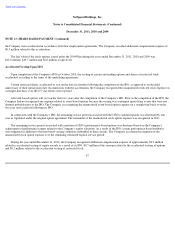

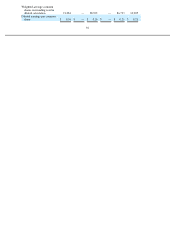

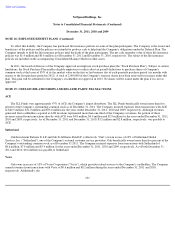

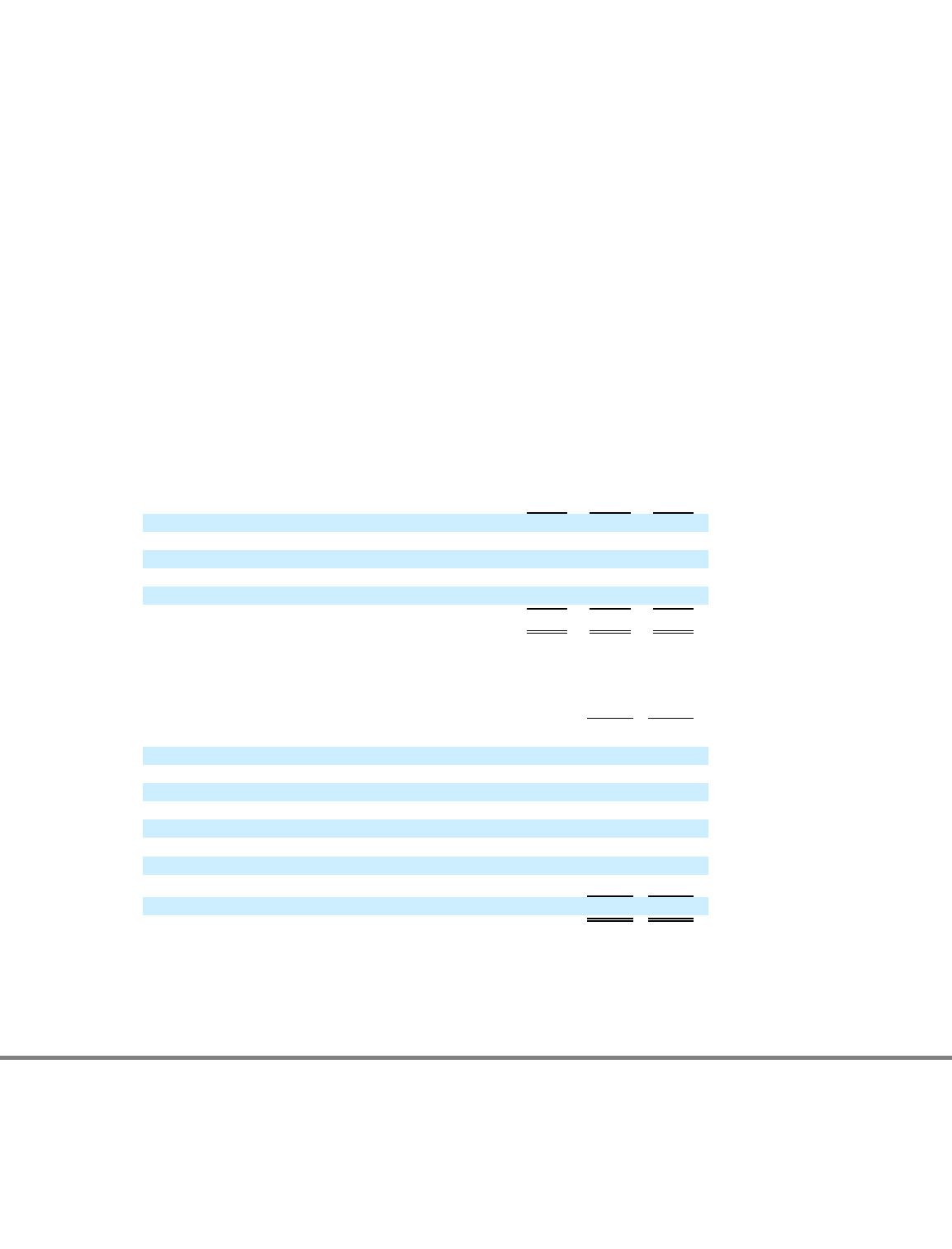

For the years ended December 31, 2011 and 2010, the total amount of unrecognized tax benefits was as follows:

Included in the balance of unrecognized tax benefits as of both December 31, 2011 and 2010 are approximately $0.3 million of tax

benefits that, if recognized, would impact the effective tax rate. Also

95

2011 2010 2009

Federal statutory rate

35.0

%

35.0

%

35.0

%

State taxes, net of federal benefit

2.8

3.2

3.3

Permanent items

—

(

0.1

)

0.2

Stock compensation

1.7

1.8

2.8

Other

0.1

(1.2

)

(0.6

)

Provision for income tax

39.6

%

38.7

%

40.7

%

2011 2010

(in thousands

of dollars)

Balance as of beginning of year

$

401

$

195

Tax positions related to current year:

Additions

22

187

Reductions

—

—

Tax positions related to prior years:

Additions

—

19

Reductions

—

—

Settlements

—

—

Balance as of end of year

$

423

$

401