NetSpend 2011 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

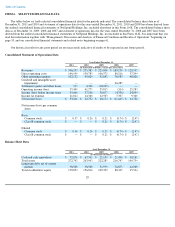

processing platforms and call center activities. Settlement (gains) and other losses during the year ended December 31, 2010 relate to a

$3.5 million loss related to a patent infringement dispute and a $0.8 million loss associated with a contractual dispute with an Issuing

Bank. Settlement (gains) and other losses during the year ended December 31, 2009 relate to $9.0 million of funds received from our

Issuing Banks for fee and chargeback recoveries and $1.2 million resulting from the settlement of certain litigation.

The loss on extinguishment of debt during the year ended December 31, 2010 relates to a $0.7 million write-off of the remaining

capitalized debt issuance costs associated with our prior credit facility.

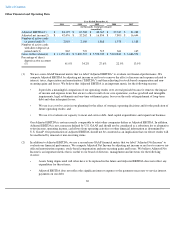

The following is a reconciliation of our net income (loss), the most comparable GAAP measure, for the years ended December 31, 2011,

2010, 2009, 2008 and 2007 to Adjusted Net Income.

32

Year Ended December 31,

2011 2010 2009 2008 2007

(in thousands of dollars)

Net income (loss)

$

33,246

$

22,732

$

18,174

$

(11,645

)

$

14,726

Stock

-

based compensation expense

11,242

7,268

4,484

2,473

754

Goodwill and acquired intangible asset

impairment

—

—

—

26,285

—

Amortization of intangibles

3,524

3,245

3,516

3,224

2,385

Settlement (gains) and other losses

515

4,300

(10,229

)

—

—

Loss on extinguishment of debt

—

734

—

—

—

Total pre

-

tax adjustments

15,281

15,547

(2,229

)

31,982

3,139

Tax rate(1)

39.6

%

38.7

%

40.8

%

39.2

%

38.9

%

Tax adjustment

6,051

6,017

(909

)

12,537

1,221

Adjusted net income

$

42,476

$

32,262

$

16,854

$

7,800

$

16,644

Settlement (gains) and other losses of $0.5 million during the year ended December 31, 2011 primarily relate to

severance costs incurred in connection with the consolidation of some of our processing platforms and call center

activities. Settlement (gains) and other losses during the year ended December 31, 2010 relate to a $3.5 million loss

related to a patent infringement dispute and a $0.8 million loss associated with a contractual dispute with an Issuing

Bank. Settlement (gains) and other losses during the year ended December 31, 2009 relate to $9.0 million of funds

received from our Issuing Banks for fee and chargeback recoveries and $1.2 million resulting from the settlement of

certain litigation.

The loss on extinguishment of debt during the year ended December 31, 2010 relates to a $0.7 million write-off of the

remaining capitalized debt issuance costs associated with our prior credit facility.

(1) The 2008 tax rate was adjusted to remove the impact of the goodwill impairment charge recorded during 2008 in order to

establish the rate used to book taxes in the absence of this impairment charge consistent with the pre-

tax adjustments used

to calculate adjusted net income.