NetSpend 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2011, 2010 and 2009

NOTE 19: CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS (Continued)

Company incurred expenses from transactions with Vesta of $0.6 million and $0.2 million during the years ended December 31, 2011 and

2010, respectively. The Company earned no revenues and incurred no expenses from transactions with Vesta during the year ended

December 31, 2009.

Birardi

During the year ended December 31, 2011, the Company incurred expenses of $0.1 million for charges related to the use by the

Company's CEO of an airplane owned by Birardi Investments, LLC ("Birardi"). During each of the years ended December 31, 2010 and 2009,

the Company incurred expenses of $0.2 million for charges related to these services. Birardi is an airplane leasing company that is owned by

the CEO.

Henry CJ1 LLC

The Company incurred expenses of $0.1 million during the year ended December 31, 2011 for charges related to the use by the

Company's CEO of an airplane owned by Henry CJ1, LLC ("Henry CJ1"). Henry CJ1 is an airplane leasing company that is owned by the

CEO. The Company incurred no such expenses during the years ended December 31, 2010 or 2009.

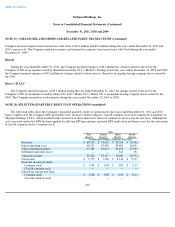

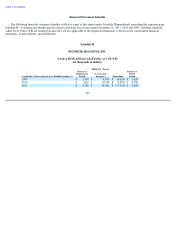

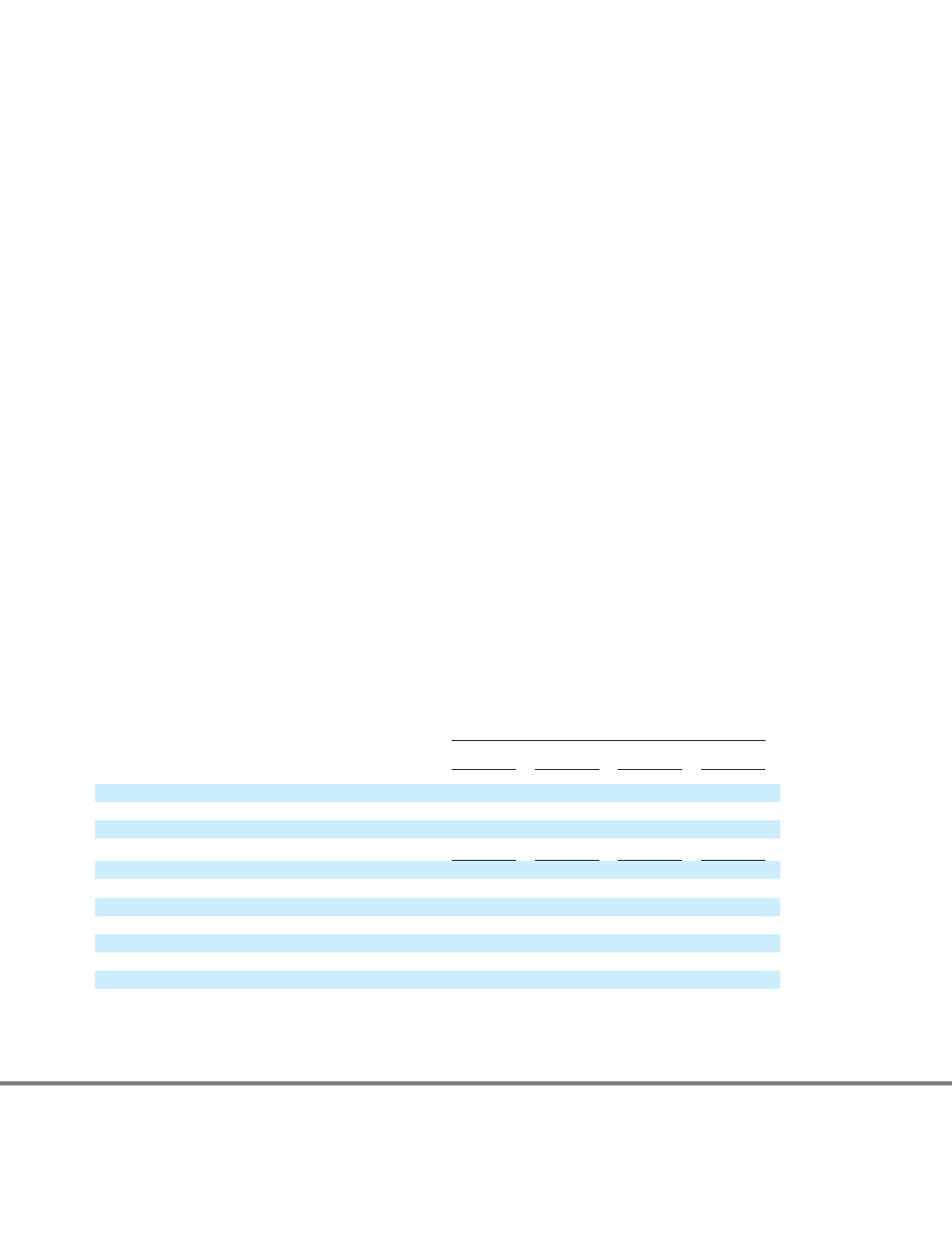

NOTE 20: SELECTED QUARTERLY RESULTS OF OPERATIONS (unaudited)

The following tables show the Company's unaudited quarterly results of operations for the years ended December 31, 2011 and 2010.

Upon completion of the Company's IPO in October 2010, all shares of the Company's class B common stock were transferred to members of

Skylight Holdings I, LLC, which resulted in the conversion of those shares into shares of common stock on a one-for-one basis. Although the

as-if converted method for EPS has been applied for full year EPS presentation, quarterly EPS results have not been re-cast for the conversion

of class B common stock to common stock.

102

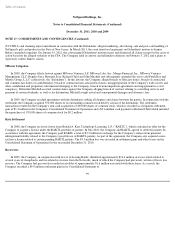

2011

First

Quarter Second

Quarter Third

Quarter Fourth

Quarter

(in thousands of dollars, except per share data)

Revenues

$

80,750

$

74,419

$

74,324

$

76,762

Direct operating costs

40,133

35,489

34,483

36,094

Other operating expenses

27,383

25,813

25,233

23,703

Settlement and other losses

—

—

324

191

Operating income

13,234

13,117

14,284

16,774

Net income

$

7,779

$

7,580

$

8,310

$

9,577

Basic net income per share

Common stock

$

0.08

$

0.08

$

0.09

$

0.11

Class B common stock

—

—

—

—

Diluted net income per share

Common stock

$

0.08

$

0.08

$

0.09

$

0.11

Class B common stock

—

—

—

—