NetSpend 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2008, 2009 and 2010

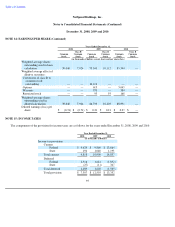

NOTE 12: SHARE BASED PAYMENT (Continued)

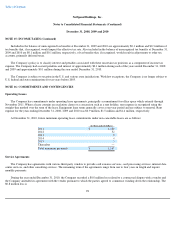

Restricted Stock

During the year ended December 31, 2008 the Company issued 0.5 million shares of restricted stock in connection with the Skylight

acquisition. The fair value of these shares was not included in the Skylight purchase price, and is being recognized as compensation expense on

a straight-line basis as the forfeiture restrictions lapse over three to five year time periods.

The Company did not issue any restricted stock during the year ended December 31, 2009.

During the year ended December 31, 2010, the Company issued 0.7 million shares of restricted stock to its employees that vest annually

over three or four year periods. Upon completion of the Company's initial public offering, the vesting of 0.3 million restricted shares

accelerated to vest on the date six months following the completion of the initial public offering.

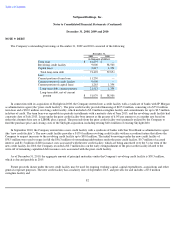

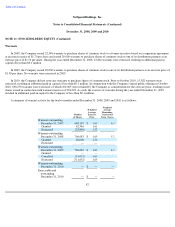

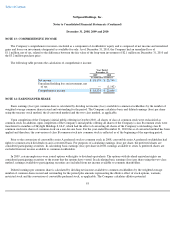

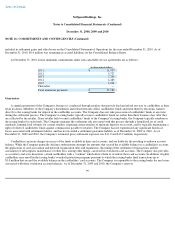

Activity related to the Company's restricted stock awards during the year ended December 31, 2010 is as follows:

Stock-Based Compensation Expense

During the years ended December 31, 2008, 2009 and 2010, the Company recorded total stock-based compensation expense of

$2.5 million, $4.5 million and $7.3 million, respectively.

At December 31, 2010, the Company's outstanding options had a weighted average remaining contractual term of 7.8 years. As of

December 31, 2010, unrecognized compensation cost related to stock options amounted to $13.7 million and is expected to be recognized over

a weighted average period of 1.8 years. At December 31, 2010, unrecognized stock-based compensation cost related to restricted stock

amounted to $2.6 million and is expected to be recognized over a weighted average period of 2.2 years. The amount of unrecognized stock-

based compensation will be affected by any future stock option or restricted stock grants.

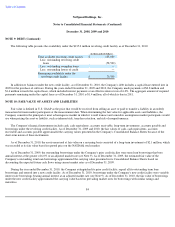

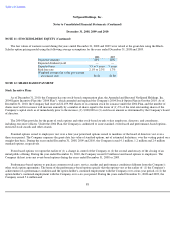

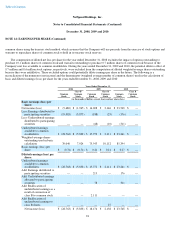

The Company considers the type of awards, employee class and historical experience in estimating the annual forfeiture rate. The

following table summarizes the Company's estimated annualized forfeiture rates for the years ended December 31, 2008, 2009 and 2010:

92

Shares of Unvested

Restricted Stock

Outstanding

Weighted Average

Grant Date

Fair Value

Balance at December 31,

2009

262,073

$

3.47

Granted

674,043

5.76

Vested

(215,050

)

3.47

Forfeited

(30,703

)

3.62

Balance at December 31,

2010

690,363

$

5.70

2008 2009 2010

Executive Officer level

3.0

%

8.0

%

9.0

%

Vice President and Director level

10.0

%

10.0

%

15.0

%

Below Director level

23.6

%

12.5

%

12.5

%