NetSpend 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2008, 2009 and 2010

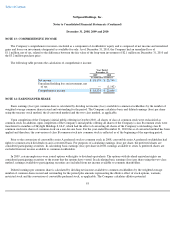

NOTE 18: CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

ACE

Prior to the acquisition of Skylight on July 15, 2008, Skylight was owned by JLL Partners Fund IV, LP and JLL Partners Fund V, LP

(collectively "the JLL Funds"), which also own approximately 97% of ACE Cash Express, Inc. ("ACE"), the Company's largest distributor. As

a result of the Skylight transaction, the JLL Funds became the beneficial owner of more than five percent of the Company's outstanding

common stock and class B common stock and the Company entered into an amended and restated independent agency agreement with ACE

through March 2016 related to the sale of the Company's gift and GPR cards. The Company incurred expenses from transactions with ACE of

$17.1 million, $23.0 million and $31.0 million for the years ended December 31, 2008, 2009 and 2010, respectively. Although revenues

generated from cardholders acquired at ACE represent approximately one third of the Company's revenues, the portion of those revenues

earned from transactions directly with ACE were $1.6 million, $2.9 million and $4.4 million for the years ended December 31, 2008, 2009 and

2010, respectively. At December 31, 2009 and 2010, $2.0 million and $2.8 million, respectively, was payable to ACE.

Sutherland

Oak Investment Partners X, LP and Oak X Affiliates Fund LP (collectively "Oak") own in excess of 10% of Sutherland Global

Services, Inc. ("Sutherland"), one of the Company's external customer service providers. Oak is a beneficial owner of more than five percent of

the Company's outstanding common stock. The Company incurred expenses from transactions with Sutherland of $7.3 million, $5.9 million

and $7.4 million, for the years ended December 31, 2008, 2009 and 2010, respectively. At December 31, 2009 and 2010, $1.2 million and

$0.6 million, respectively, was payable to Sutherland.

Vesta

Oak owns in excess of 10% of Vesta Corporation ("Vesta"), one of the Company's vendors. Oak is a beneficial owner of more than five

percent of the Company's outstanding common stock. The Company earned revenues from transactions with Vesta of $0.2 million during the

year ended December 31, 2010. Additionally, the Company incurred expenses from transactions with Vesta of $0.2 million during the year

ended December 31, 2010. The Company earned no revenues and incurred no expenses from transactions with Vesta during the years ended

December 31, 2008 and 2009.

Birardi

During each of the years ended December 31, 2008, 2009 and 2010, the Company incurred expenses of $0.2 million for charges related to

the CEO's use of an airplane owned by Birardi Investments, LLC ("Birardi"). Birardi is an airplane leasing company that is partially owned by

the CEO.

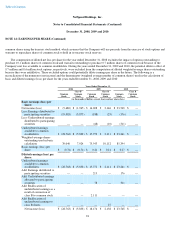

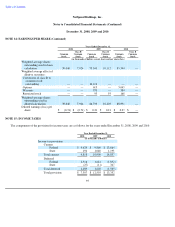

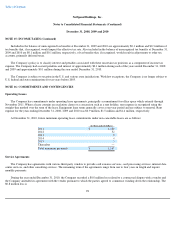

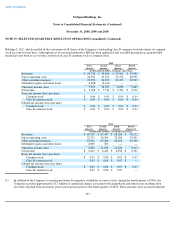

NOTE 19: SELECTED QUARTERLY RESULTS OF OPERATIONS (unaudited)

The following tables show unaudited quarterly results of operations for the years ended December 31, 2009 and 2010. Upon completion of

the Company's initial public offering in October 2010, all shares of the Company's class B common stock were transferred to members of

Skylight

102