NetSpend 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

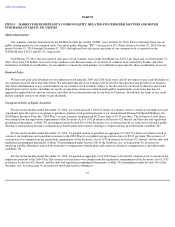

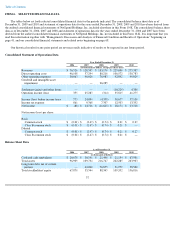

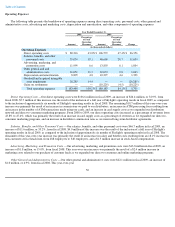

The following is a reconciliation of our net income (loss), the most comparable GAAP measure, for the years ended December 31, 2006,

2007, 2008, 2009 and 2010 to Adjusted Net Income.

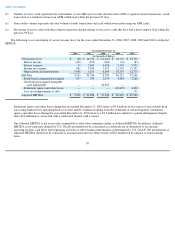

Settlement (gains) and other losses during the year ended December 31, 2009 relate to $9.0 million of recoveries of excess funds from

our issuing banks for fee and chargeback recoveries and $1.2 million resulting from the settlement of certain litigation. Settlement

(gains) and other losses during the year ended December 31, 2010 relate to a $3.5 million loss related to a patent infringement dispute

and a $0.8 million loss associated with a contractual dispute with a vendor.

Our Adjusted Net Income is not necessarily comparable to what other companies define as Adjusted Net Income. In addition, Adjusted

Net Income is not a measure defined by U.S. GAAP and should not be considered as a substitute for or alternative to net income,

operating income, cash flows from operating activities or other financial information as determined by U.S. GAAP. Our presentation of

Adjusted Net Income should not be construed as an implication that our future results will be unaffected by unusual or non-recurring

items.

(1) The 2008 tax rate was adjusted to remove the impact of the goodwill impairment charge recorded during 2008 in order to establish the

rate used to book taxes in the absence of this impairment charge consistent with the pre-tax adjustments used to calculate adjusted net

income.

40

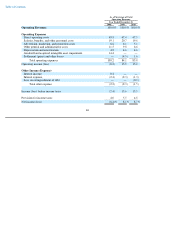

Year Ended December 31,

2006 2007 2008 2009 2010

(in thousands of dollars)

Net income (loss)

$

(88

)

$

14,726

$

(11,645

)

$

18,174

$

23,748

Stock

-

based compensation

expense

857

754

2,473

4,484

7,268

Goodwill and acquired intangible

asset impairment

—

—

26,285

—

—

Amortization of intangibles

2,385

2,385

3,224

3,516

3,245

Settlement (gains) and other

losses

—

—

—

(

10,229

)

4,300

Loss on extinguishment of debt

—

—

—

—

734

Total pre

-

tax adjustments

3,242

3,139

31,982

(2,229

)

15,547

Tax Rate(1)

111.4

%

38.9

%

39.2

%

40.8

%

36.0

%

Tax adjustment

3,612

1,221

12,537

(909

)

5,595

Adjusted net income

$

(458

)

$

16,644

$

7,800

$

16,854

$

33,700