NetSpend 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

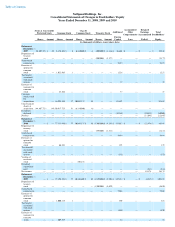

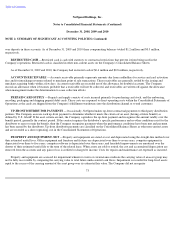

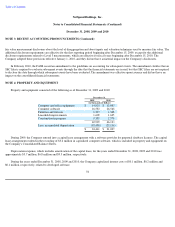

NetSpend Holdings, Inc.

Consolidated Statements of Changes in Stockholders' Equity

Years Ended December 31, 2008, 2009 and 2010

Series A Convertible

Preferred Stock

Class B

Common Stock

Common Stock

Treasury Stock

Accumulated

Other

Comprehensive

Loss

Retained

Earnings

(Accumulated

Deficit)

Additional

Paid-in

Capital

Total

Stockholders'

Equity

Shares

Amount

Shares

Amount

Shares

Amount

Shares

Amount

(in thousands of dollars, except share data)

Balances at

December 31,

2007

44,807,723

$

45

8,174,821

$

8

6,110,000

$

6

(400,000

)

$

(1,116

)

$

36,601

$

—

$

—

$

35,544

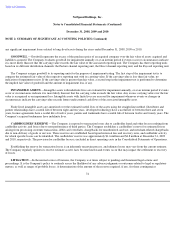

Repurchase of

treasury

stock

—

—

—

—

—

—

(

900,000

)

(3,177

)

—

—

—

(

3,177

)

Stock-based

compensation

—

—

—

—

—

—

—

—

2,473

—

—

2,473

Exercise of

options for

common

stock

—

—

1,022,965

1

—

—

—

—

1,226

—

—

1,227

Tax benefit

associated

with stock

options

—

—

—

—

—

—

—

—

37

—

—

37

Exercise of

warrants for

common

stock

—

—

23,846

—

—

—

—

—

37

—

—

37

Common

stock issued

for

acquisitions

—

—

16,992,555

17

10,043,137

10

—

—

93,822

—

—

93,849

Conversion of

shares at

acquisition

(44,807,723

)

(45

)

50,917,723

51

(6,110,000

)

(6

)

—

—

—

—

—

—

Dividends

declared

—

—

—

—

—

—

—

—

(

19,169

)

—

(

10,831

)

(30,000

)

Net loss

—

—

—

—

—

—

—

—

—

—

(

11,645

)

(11,645

)

Balances at

December 31,

2008

—

$

—

77,131,910

$

77

10,043,137

$

10

(1,300,000

)

$

(4,293

)

$

115,027

$

—

$

(

22,476

)

$

88,345

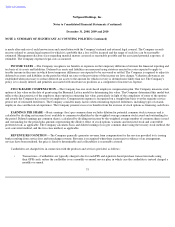

Repurchase of

treasury

stock

—

—

—

—

—

—

(

570,000

)

(1,411

)

—

—

—

(

1,411

)

Stock-based

compensation

—

—

—

—

—

—

—

—

4,484

—

—

4,484

Exercise of

options for

common

stock

—

—

66,283

—

—

—

—

—

125

—

—

125

Tax shortfall

associated

with stock

options

—

—

—

—

—

—

—

—

(

152

)

—

—

(

152

)

Vesting of

restricted

stock

—

—

—

—

201,472

—

—

—

—

—

—

—

Dividend

equivalents

paid

—

—

—

—

—

—

—

—

—

—

(

213

)

(213

)

Net income

—

—

—

—

—

—

—

—

—

—

18,174

18,174

Balances at

December 31,

2009

—

$

—

77,198,193

$

77

10,244,609

$

10

(1,870,000

)

$

(5,704

)

$

119,484

$

—

$

(

4,515

)

$

109,352

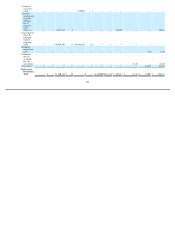

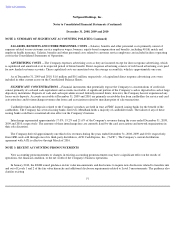

Repurchase of

treasury

stock

—

—

—

—

—

—

(

1,500,000

)

(5,670

)

—

—

—

(

5,670

)

Stock-based

compensation

—

—

—

—

—

—

—

—

7,268

—

—

7,268

Exercise of

options for

common

stock

—

—

1,000,215

1

—

—

—

—

850

—

—

851

Tax benefit

associated

with stock

options

—

—

—

—

—

—

—

—

1,520

—

—

1,520

Exercise of

warrants for

common

stock

—

—

609,587

1

—

—

—

—

82

—

—

83