NetSpend 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2008, 2009 and 2010

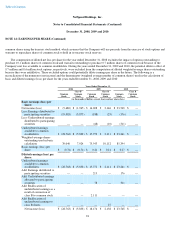

NOTE 11: STOCKHOLDERS' EQUITY (Continued)

Company paid $25.0 million of the $30.0 million dividend in 2008, and paid the remaining $5.0 million in 2009.

Prior to the Company's acquisition of Skylight, the Company was authorized to issue convertible preferred stock. The preferred stock had

an aggregate liquidation preference of $1.24189 per share, conversion rights, voting rights, and dividend participation rights on an as-if-

converted basis for dividends declared by the board of directors on common stock. In connection with the Skylight acquisition, all outstanding

shares of series A preferred stock were converted into 44,807,723 shares of common stock.

In connection with the Company's acquisition of Procesa in December 2008 the Company issued 86,455 shares of common stock at the

then-current fair market value of $3.47 per share.

Treasury Stock Transactions

Treasury stock is accounted for under the cost method and is included as a component of stockholders' equity.

In 2008, the Company's then Chief Executive Officer separated from the Company. As a part of his separation agreement, the Company

repurchased 900,000 shares of his common stock (formerly "class A common stock") for approximately $3.2 million.

In 2009, the Company reached agreements with defendants named in the MPower litigation, settling all disputes and claims between the

Company and the defendants (see Note 16). In connection with the settlement, the Company assumed 570,000 shares of its outstanding

common stock (formerly "class A common stock") held by the defendants. The settlement transactions resulted in the Company's non-cash

acquisition of 400,000 shares of treasury stock, which is recorded as a litigation settlement gain of $1.2 million on the Company's Consolidated

Statement of Operations, and a $0.2 million cash purchase of 170,000 shares of treasury stock.

In 2010, the Company repurchased 1,500,000 shares of its common stock (formerly "class A common stock") for $5.7 million.

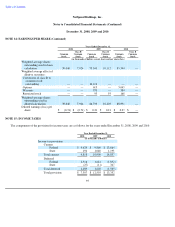

Dividend Equivalents

Certain employee stock options contain rights to dividend equivalents. The Company did not pay any dividend equivalents during the year

ended December 31, 2008. In each of the years ended December 31, 2009 and 2010, the Company paid $0.2 million in cash dividend

equivalents related to certain of its employee stock options. The dividend equivalents were paid when the underlying options vested.

Dividends

In 2008, the Company declared a $30.0 million dividend. The Company paid $25.0 million of the $30.0 million dividend in 2008 and paid

the remaining $5.0 million in March 2009. The Company did not declare or pay any dividends during the year ended December 31, 2010.

86