NetSpend 2010 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2008, 2009 and 2010

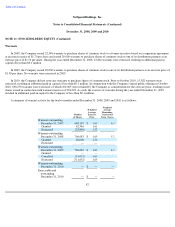

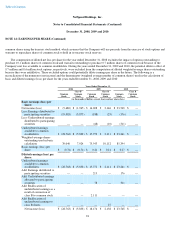

NOTE 15: INCOME TAXES (Continued)

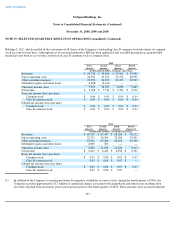

Deferred income tax assets and liabilities reflect the net tax effects of temporary differences between the carrying amounts of assets and

liabilities for financial reporting purposes and the amounts used for income tax purposes. Significant components of the Company's deferred

taxes as of December 31, 2009 and 2010 are as follows:

Deferred tax assets at December 31, 2010, were reduced by a valuation allowance relating to the unrealized loss on a long-term

investment. Due to the fact that this loss is capital in nature and could only be utilized to offset future capital gains, the Company does not

believe that it is more likely than not that the benefit of that asset would be realized in the foreseeable future. The Company will continue to

assess the potential realization of this asset and will adjust the valuation allowance in future periods as appropriate.

Upon the tax-free acquisition of Skylight in 2008, the Company purchased federal net operating losses and credits, which were subject to

use limitations under provisions of the Internal Revenue Code.

96

December 31,

2009 2010

(in thousands of dollars)

Deferred tax assets

Current deferred tax assets

Deferred revenue

$

727

$

1,223

Accrued expenses

2,100

2,522

Prepaid card supply costs

30

161

Net operating loss and tax credit

carryforwards

15

10

Total current deferred tax assets

2,872

3,916

Non

-

current deferred tax assets

Accrued expenses

65

72

Net operating loss and tax credit

carryforwards

471

230

Unrealized loss on long-term

investment

—

413

Stock compensation

1,091

2,575

Gross non

-

current deferred tax assets

1,627

3,290

Valuation allowance

—

(

413

)

Total non

-

current deferred tax assets

1,627

2,877

Deferred tax liabilities

Non

-

current deferred tax liabilities

Acquired intangibles

(10,356

)

(9,278

)

Depreciation and amortization

(1,589

)

(3,454

)

Total non-current deferred tax

liabilities

(11,945

)

(12,732

)

Net current deferred tax asset

2,872

3,916

Net non

-

current deferred tax liability

$

(10,318

)

$

(9,855

)