NetSpend 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2008, 2009 and 2010

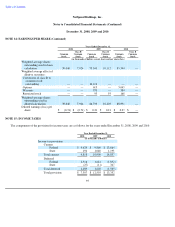

NOTE 11: STOCKHOLDERS' EQUITY (Continued)

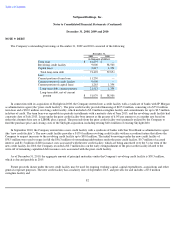

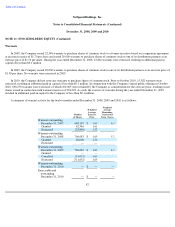

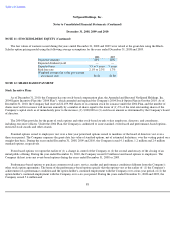

The fair values of warrants issued during the years ended December 31, 2008 and 2009 were valued at the grant date using the Black-

Scholes option pricing model using the following average assumptions for the years ended December 31, 2008 and 2009.

NOTE 12: SHARE BASED PAYMENT

Stock Incentive Plans

As of December 31, 2010, the Company has one stock-based compensation plan, the Amended and Restated NetSpend Holdings, Inc.

2004 Equity Incentive Plan (the "2004 Plan"), which amended and replaced the Company's 2004 Stock Option Plan in October 2010. As of

December 31, 2010, the Company had reserved 22,459,980 shares of its common stock for issuance under the 2004 Plan, and the number of

shares reserved for issuance will increase annually by a number of shares equal to the lesser of (1) 3% of the total outstanding shares of the

Company's capital stock as of immediately prior to the increase, (2) 3,000,000 or (3) such lesser amount as determined by the Company's board

of directors.

The 2004 Plan provides for the grant of stock options and other stock-based awards to key employees, directors, and consultants,

including executive officers. Under the 2004 Plan, the Company is authorized to issue standard, event-based and performance-based options,

restricted stock awards and other awards.

Standard options issued to employees vest over a four-year period and options issued to members of the board of directors vest over a

three-year period. The Company expenses the grant-

date fair value of standard options, net of estimated forfeitures, over the vesting period on a

straight-line basis. During the years ended December 31, 2008, 2009 and 2010, the Company issued 4.1 million, 1.2 million and 2.4 million

standard options, respectively.

Event-based options vest upon the earlier of (1) a change in control of the Company or (2) the second anniversary of the closing of an

initial public offering. During the year ended December 31, 2010, the Company issued 0.9 million event-based options to employees. The

Company did not issue any event-based options during the years ended December 31, 2008 or 2009.

Performance-based options to purchase common stock carry service, market and performance conditions different from the Company's

other stock option agreements. The terms of the performance-based options specify that the options vest at the earlier of: (1) the Company's

achievement of a performance condition and the option holder's continued employment with the Company over a four-year period, or (2) the

option holder's continued employment with the Company over a six-year period. During the years ended December 31, 2008 and 2009, the

Company issued 5.4 million and

88

2008 2009

Expected volatility

40%

60%

Expected dividend yield

—

—

Expected term

3.5 to 5 years

5 years

Risk free rate

2.1% to 2.3%

1.7%

Weighted average fair value per warrant

at issuance date

$1.81

$1.80