NetSpend 2010 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Business Strategy

We aim to be the leading provider of GPR cards and related alternative financial services to underbanked consumers. To achieve this goal,

we have developed a multi-pronged growth strategy that leverages our core capabilities to address expanding market opportunities for our

services.

Increase Cardholder Usage and Retention

We plan to increase cardholder usage and retention by increasing the number of our cardholders who direct deposit their wages,

government benefits or tax refunds onto their cards, as well as through marketing programs, product development, customer support and joint

marketing efforts with our distributors. We plan to continue to provide competitive pricing while adding functionality and complementary

products and services that will encourage underbanked consumers to use our cards as the equivalent of a traditional bank account over a longer

period of time.

Increase Penetration of the Underbanked Consumer Market

We plan to focus on further penetrating the existing underbanked consumer market and attracting new categories of consumers who are

dissatisfied with the traditional banking system by:

• increasing our retail card sales by providing superior product offerings and pricing for underbanked consumers seeking cash or

bank alternatives;

• developing new distribution relationships with leading national retailers and corporate employers;

• continuing to grow and diversify our reload network; and

• improving the effectiveness and efficiency of our direct-to-consumer and online marketing programs.

Leverage Our Technology Platform to Increase Profitability

Our end-to-end, proprietary technology platform provides us with attractive economies of scale, flexible product development capabilities

and speed to market with differentiated product offerings. In addition, we continue to drive new efficiencies in our business, such as the

continued integration of Skylight's infrastructure with our operational and technology platform. As we continue to increase our number of

active cards and the volume of transactions we process, we believe we will be able to increase our profitability.

Products and Services

GPR Cards

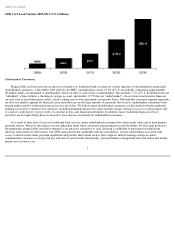

The GPR card is our core product. As of December 31, 2010, we had approximately 2.1 million active cards and our GPR cards were

responsible for approximately 97.7% of our total revenues for the year ended December 31, 2010. We consider a GPR card to be "active" if a

personal identification number, or PIN, or signature-based purchase transaction, a load transaction at a retailer location, or an ATM withdrawal

has been made with respect to such card within the previous 90 days. Marketed and processed by us and issued by our issuing banks, our GPR

card is a prepaid debit card tied to an FDIC-insured depository account maintained by us, with the funds held at an issuing bank on behalf of

the cardholder. Our GPR card represents the equivalent of a bank account for underbanked consumers and is marketed through our network of

retail distributors, our direct-to-consumer and online marketing programs and corporate employers as an alternative method of wage payment

rather than through bank branches. Our GPR cards can be used to make purchase transactions at any merchant

5