NetSpend 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

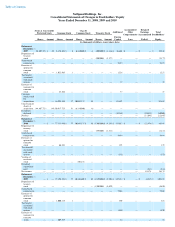

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2008, 2009 and 2010

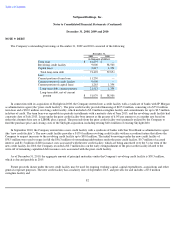

NOTE 5: GOODWILL

In 2004, the Company recorded its initial $52.1 million goodwill balance through a recapitalization transaction pursuant to which

NetSpend Holdings, as a newly formed holding company incorporated in Delaware, acquired all of the capital stock of NetSpend Corporation.

In 2008, the Company recorded additional goodwill of $99.5 million as a result of acquisitions of Skylight Financial, Inc. ("Skylight"), a

company in the prepaid card industry that is focused on the market for direct deposit payroll accounts, and Procesa International, LLC

("Procesa"), a service provider for direct, cross-border, and cell phone top-up payment services for Latin America.

Goodwill is tested for impairment annually or if an event occurs or conditions change that would more likely than not reduce the fair value

of the reporting unit below its carrying value. The determination of fair value used in the impairment evaluation is based on a combination of

comparative market multiples and discounted cash flow analyses.

In 2008, the Company determined that the carrying value of the Paycard reporting unit exceeded its fair value based on a combination of

comparative market multiples and discounted cash flow analyses, indicating that goodwill was potentially impaired. As a result, the Company

initiated the second step of the goodwill impairment test, which involved calculating the implied fair value of goodwill by allocating the fair

value of the reporting unit to all assets and liabilities of the reporting unit other than goodwill, and comparing it to the carrying amount of

goodwill. The Company determined that the implied fair value of goodwill related to the Paycard reporting unit was less than its carrying value

by approximately $23.0 million, which was recorded as a goodwill impairment charge in 2008. The impairment was caused by declining

market conditions and the adverse business environment in which the Paycard reporting unit was operating.

In 2009 and 2010, the Company performed its goodwill impairment evaluations and determined that the fair value of its goodwill

exceeded the carrying value. No impairment charges were recorded in the years ended December 31, 2009 or 2010.

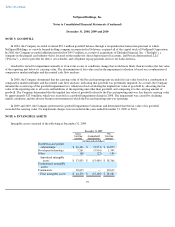

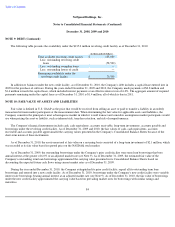

NOTE 6: INTANGIBLE ASSETS

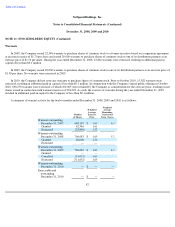

Intangible assets consisted of the following at December 31, 2009:

79

December 31, 2009

Gross

Carrying

Amount Accumulated

Amortization

Net

Carrying

Amount

(in thousands of dollars)

Distributor and partner

relationships

$

26,426

$

(9,551

)

$

16,875

Developed technology

7,261

(5,916

)

1,345

Other

168

(22

)

146

Amortized intangible

assets

$

33,855

$

(15,489

)

$

18,366

Unamortized intangible

assets:

Tradenames

10,615

—

10,615

Total intangible assets

$

44,470

$

(15,489

)

$

28,981