NetSpend 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2008, 2009 and 2010

NOTE 3: RECENT ACCOUNTING PRONOUNCEMENTS (Continued)

fair value measurement disclosures about the level of disaggregation and about inputs and valuation techniques used to measure fair value. The

additional disclosure requirements are effective for the first reporting period beginning after December 15, 2009, except for the additional

disclosure requirements related to Level 3 measurements, which are effective for fiscal years beginning after December 15, 2010. The

Company adopted these provisions effective January 1, 2010, and they did not have a material impact on the Company's disclosures.

In February 2010, the FASB issued an amendment to the guidelines on accounting for subsequent events. The amendment clarifies that an

SEC filer is required to evaluate subsequent events through the date that the financial statements are issued, but that SEC filers are not required

to disclose the date through which subsequent events have been evaluated. The amendment was effective upon issuance and did not have an

impact on the consolidated financial statements.

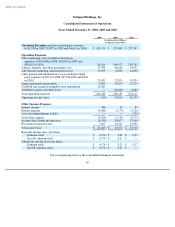

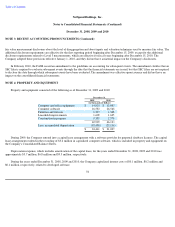

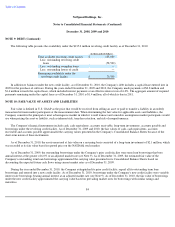

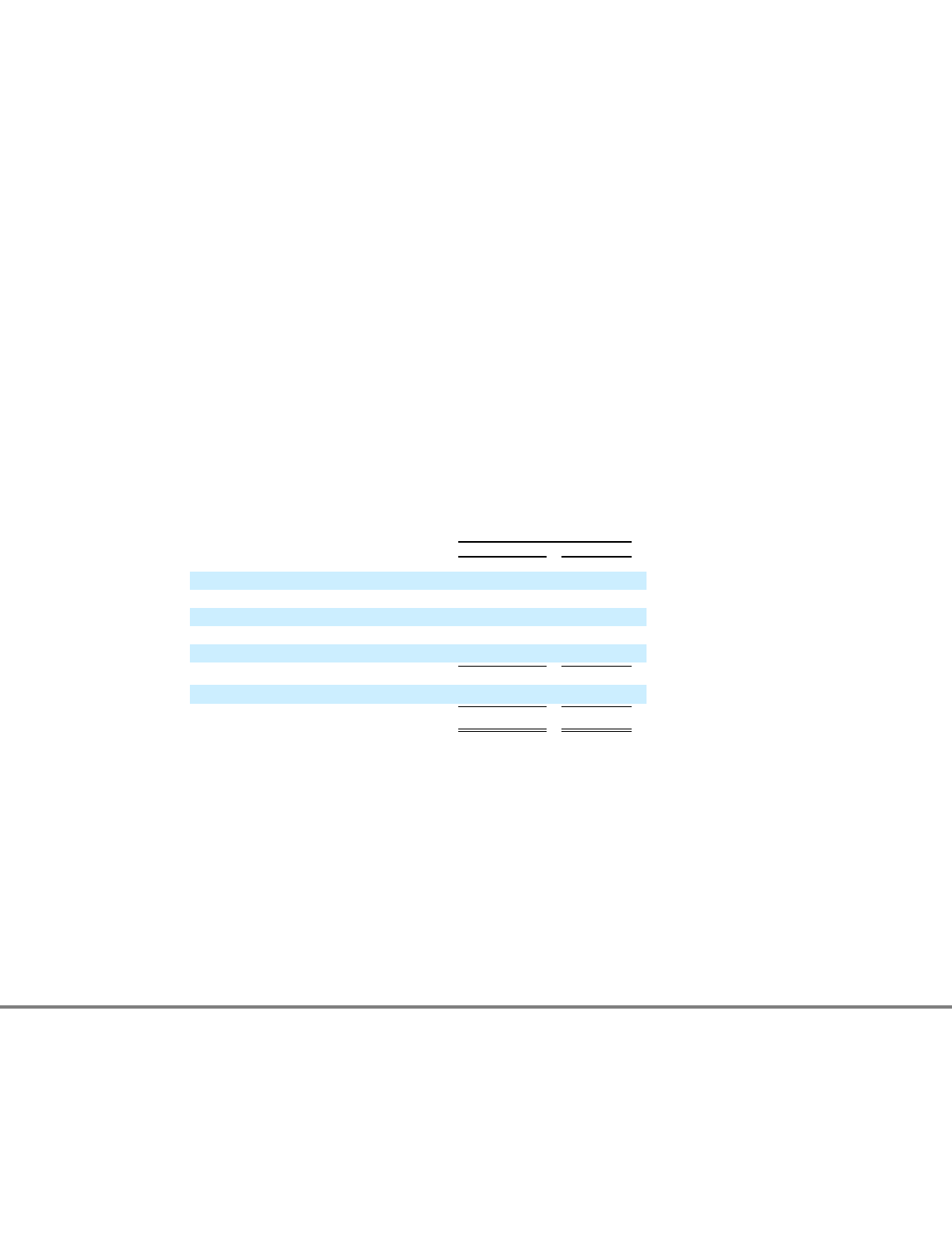

NOTE 4: PROPERTY AND EQUIPMENT

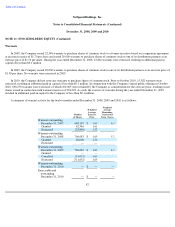

Property and equipment consisted of the following as of December 31, 2009 and 2010:

During 2009, the Company entered into a capital lease arrangement with a software provider for perpetual database licenses. The capital

lease arrangement resulted in the recording of $3.4 million in capitalized computer software, which is included in property and equipment on

the Company's Consolidated Balance Sheets.

Depreciation expense, which includes amortization of the capital lease, for the years ended December 31, 2008, 2009 and 2010 was

approximately $5.7 million, $6.8 million and $9.5 million, respectively.

During the years ended December 31, 2008, 2009 and 2010, the Company capitalized interest costs of $0.1 million, $0.2 million and

$0.1 million, respectively, related to developed software.

78

December 31,

2009 2010

(in thousands of dollars)

Computer and office equipment

$

14,033

$

13,983

Computer software

16,583

26,568

Furniture and fixtures

1,317

1,368

Leasehold improvements

1,609

1,625

Construction in progress

9,387

2,579

42,929

46,123

Less: accumulated depreciation

(18,488

)

(25,116

)

$

24,441

$

21,007